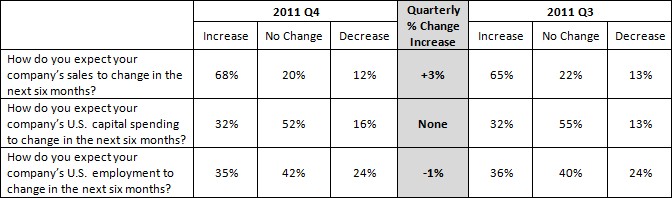

The results from this morning’s Business Roundtable survey of CEO’s showed a bit of a mixed bag with improvements in sales, declines in expected hiring and a generally sluggish environment:

The results of Business Roundtable’s fourth quarter CEO Economic Outlook Survey show a continuation of third quarter expectation trends for sales, capital spending and hiring.

“The findings of this survey reflect the continuation of a slow, uneven recovery characterized by ongoing economic uncertainty for American businesses,” said Jim McNerney, Chairman of Business Roundtable and Chairman, President and CEO of The Boeing Company.

Survey Results

The survey’s key findings from this quarter and the third quarter of 2011 include:

Bank of America’s recent survey of CFO’s confirmed the outlook from the Business Roundtable citing the weakest survey results in the 14 year history of the B of A survey:

“Financial chiefs at U.S. companies are less optimistic about economic growth in 2012 than in previous years, however, the majority don’t expect work force reductions next year, according to a recent chief financial officer outlook survey by Bank Of AmericaCorp.

According to the annual latest survey of 600 executives by Bank Of America Merrill Lynch, 38% of respondents said they expect the U.S. economy to grow in 2012, down from 56% a year ago and 66% the prior year.

CFOs rated the economy a score of 44 out of 100 — its lowest score in the survey’s 14-year history. A year ago, CFOs gave the economy a score of 47.”

Sources: Business Roundtable, WSJ

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.