Janet Yellen’s Congressional testimony today brought up an interesting line of questioning from Ted Cruz who said that the Fed was “passively tightening” policy in 2008 which contributed to the financial crisis. This is a popular line of reasoning among many economists. David Beckworth, whose work I admire greatly, posted some nice comments explaining this view. In essence, by not signaling an offsetting change in the expected path of monetary policy, the Fed was not loosening in 2008. They were actually allowing financial conditions to tighten.

This view runs counterintuitive to the conventional idea that monetary policy was loosened in 2008 as the Fed cut interest rates. I don’t disagree with David and other Market Monetarists who often espouse this view. But I do think they overstate the potential for the Fed to halt the crisis. In my view, the mountain of debt that built up during the housing bubble was akin to a snow pack that became increasingly unstable. It wasn’t a matter of if it would fall, but when it would fall. And while the Fed could have done more to be proactive I think it would have taken an incredible act of prescience to make a significant difference.

The financial crisis was a complex set of interconnected avalanches, but I think we can simplify things to better understand the cause, effect and potential preventions. The Boston Fed provided a nice summary of the cause of the crisis in a 2010 report titled “Asset Bubbles and Systemic Risk”¹:

- Rapidly rising house prices led to a herding effect in the real estate market which was exacerbated by loosening lending standards.

- Higher loan-to-value ratios exposed homeowners and lenders to greater risk of falling prices, which was widely misjudged by lenders and borrowers based on historically negligible declines in home prices.²

- As the largest consumer asset and 75% of household debt, the housing market was the lynchpin in the crisis. The US economy was stable as long as housing prices increased, but as prices began to decline in 2006 this set off a slow set of mini avalanches that slowly weakened the foundation of the US financial system.

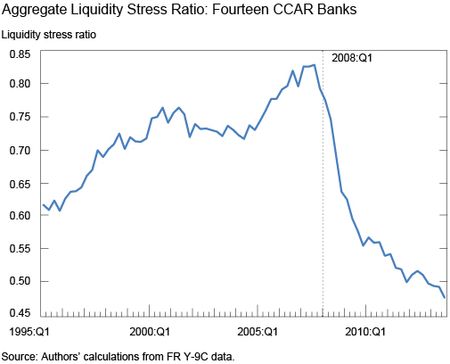

- While household debt was significant, the financial system was increasingly leveraged on top of this thanks to securitization which made the system that much more fragile as seen in the Liquidity Stress Ratio of the largest US banks:

Proponents of the “tight money” view say that the Fed should have been more proactive in 2008. But 2008 was too late. The avalanche was in motion in 2006 when home prices started to decline and by 2008 home prices were down 15% (more than 3X what firms like Lehman Brothers expected in a worst case scenario). The 2008 blow off was the last of the ice pack collapsing off the mountain we see in the above chart. And that avalanche was well in motion before the Fed had any idea how deep the crisis was (and well before 2008 when the “tight money” proponents claim stresses in the financial system became obvious).

The question is, could the Fed have had the foresight to prevent these stresses from reverting and did it have the tools to achieve that? I think the Fed certainly could have and should have done more. Many people (myself included) were extremely concerned about the rapid appreciation of house prices and the housing bubble in the period leading up to the financial crisis. The Fed could have been more proactive in trying to stop financial firms from taking on so much risk. But I don’t think it’s reasonable to expect the Fed to be able to predict how stable or unstable the mountain of US financial assets and liabilities are at certain times in the business cycle.

More importantly, the Fed didn’t really have the tools to halt the avalanche. Yes, they could have implemented something like QE much earlier than they did and this would have shored up the financial system by strengthening bank balance sheets, but this wouldn’t have stopped the avalanche of job losses in the housing sector or the price declines in the housing market. Would the crisis have been smaller if the Fed had been more proactive during the boom and the bust? Most certainly. But that assumes the Fed can properly predict and assess the fragility of the financial system consistently and in highly dynamic environments. In my opinion, that is asking too much of an entity with fairly limited tools. And this is particularly problematic for public policy as we often expect too much from an entity that simply doesn’t have the tools to meet its high demands. Monetary policy needs greater assistance from other policy makers at times and this fact doesn’t get nearly enough airtime.

¹ – “Asset Bubbles and Systemic Risk”, Boston Federal Reserve, 2010

² – Lehman Brothers, for instance, assessed the worst case scenario for home prices as a 5% decline.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.