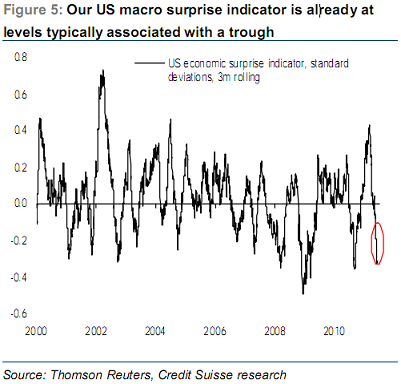

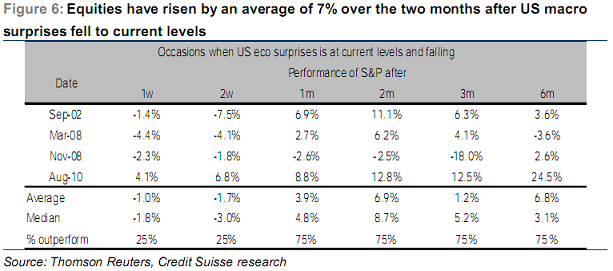

Credit Suisse’s Andrew Garthwaite is sounding the bullish siren after the 8% decline in equities over the last 6 weeks. He says short-term indicators are becoming consistent with market troughs and that the odds of a bounce are increasing. In the note he cited the CS Surprise Indicator (similar to the CitiGroup Economic Surprise Indicator) and notes that equities have tended to rally 7% after readings at these levels:

From a broader perspective, they remain quite bullish on stocks in the long-run and still believe equities have quite a bit of upside into year-end. They see a 1,450 target in the coming 6 months:

“Fundamentally, we remain bullish and stick to our year-end S&P 500 target of 1,450 (our US strategist is more cautious): a) we think this is only a mid-cycle slowdown and look for global growth of 4% this year and for US growth to reaccelerate to 3% in 2H 2011, with global IP momentum bottoming now, according to our fixed income strategy team and our 10-factor indicator of US growth recently stabilising; b) equities offer relative value: the equity risk premium is 6.3% versus our warranted equity risk premium (dependent on ISM and credit spreads) of 4.8% (potentially falling to 4.5% if the ISM improves); c) equities hedge investors against rising inflation, until inflation rises above 4% (currently inflation expectations are 2.4%); d) margins typically peak 7 months after the developed market output gap has closed and the non-financial profit share of GDP is below its 1950-70 average. We forecast 14% US EPS growth this year and 9% next; we estimate releveraging can boost EPS by 10%; e) equities are still underowned by insurance companies, while 85% of mutual fund flows since the start of 2009 have gone into bonds.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.