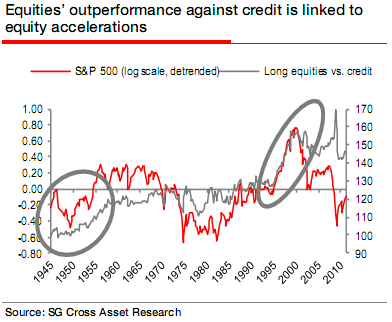

Record high corporate profits, M&A booming, corporate debt issuance resurgence, a deteriorating macro perspective and rising volatility. What’s an investor to do? Societe General says investors should look into buying a long equity, long CDS position in companies that are likely to re-leverage due to strong profits and a desire to continue the M&A boom:

- Corporate earnings recovered swiftly from Sept. 09 bottom boosting cash levels on balance sheets.

- Debt levels in private sector remained fairly stable or even slightly decreased.

Good opportunity for companies to consider strategic acquisitions, potentially releveraging in the process. Interesting way to benefit from such a scenario: Long CDS/Long Stock position:

Strategy can be implemented by buying equities and default protection through credit default swaps (Long CDS = long protection).

- To benefit from accelerations in equity market (even more so when partly fuelled by debt)

- To lock in the performance through a natural hedge against strong downturns.

Stable nature of the Long CDS/Long Stock strategy:

- Equity prices and credit spreads are roughly uncorrelated in quiet markets…

- …and closely correlated in volatile markets

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.