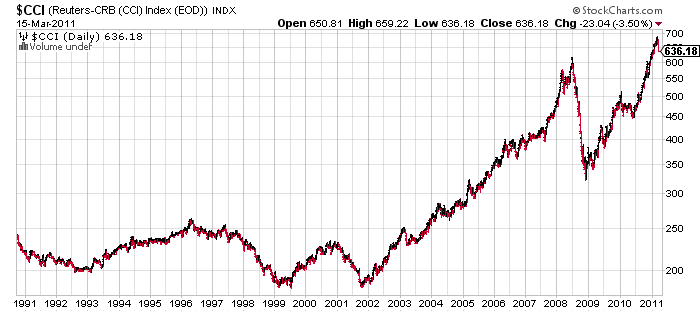

Chatter of a commodity bubble has increased in recent months as prices surge higher on a daily basis. But one question dominates the debate – if there really is a bubble when could it end? I have estimated that it would not be shocking to see the commodity bubble coincide with the end of QE2. But Ray Dalio believes it could have much more life in it. In this weekend’s Barrons Dalio said the commodity bubble was likely to persist into 2012:

The commodity bubble continues?

It continues until China and those countries become too tight, and that’s probably not until late 2012. Not only are they going to buy commodities, they are going to buy the commodity manufacturers, because there is only a certain amount of inventory of actual commodities they can hold. They are also going to buy other kinds of companies, instead of being exposed to bonds denominated in our depreciating money. You are going to see China and other creditor countries buy more assets in the U.S.

Source: Barrons

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.