Let’s start with the bad news today:

- The Chinese PMI was weak again. China’s economy is obviously slowing. I think the daily plunge in commodity prices is largely indicative of this. They’re a fairly good real-time indicator of Chinese growth. As the one strong leg of the global economy in the last 5 years, weakness in China is obviously an unwelcome development.

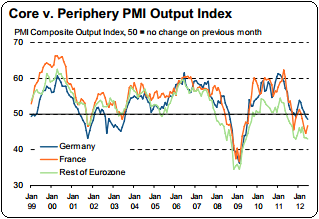

- Eurozone PMI was weak once again at 46. This is a 35 month low. The weakness is broad across Europe. Even Germany is showing signs of a slow-down, albeit from stall speeds.

(Source: Markit)

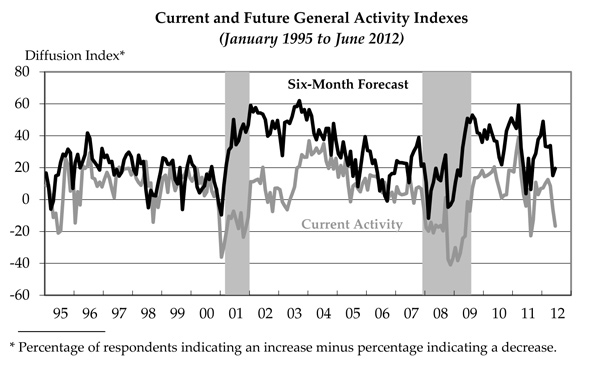

- The Philly Fed Manufacturing survey plunged from -5.5 to -16.6 in June. But the headline is a bit worse than the underlying. Employment actually picked up, prices are down and expectations of future growth remain fairly strong. Here’s a summary from the Philly Fed:

“The June Business Outlook Survey suggests that firms in the region’s manufacturing sector are experiencing declines in overall activity this month. Firms reported a notable falloff in new orders and shipments. Overall, employment remained steady, but average work hours were lower. Price pressures continued to recede this month, and more firms reported declines in prices for their own goods than reported increases. The outlook among the reporting firms, while not as optimistic as in the first quarter, suggests that firms believe that activity will rebound over the next six months.”

(Source: Philadelphia Fed)

- Jobless claims jumped to 387K versus expectations of 383K. Clearly, the labor market remains weak. No big surprises here.

There was a bit of good news as well this morning:

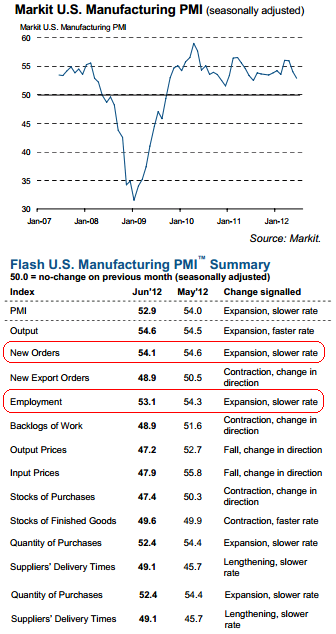

- The June flash PMI report came in at 52.9, which is below expectations, but still in an expansion phase. Ie, the US economy is not dipping into recession yet. Some highlights from Markit:”PMI lowest since July 2011, suggesting slower rate of manufacturing expansion.

Rate of output growth broadly unchanged.

New orders rise at weakest pace in four months.

Input costs fall for first time in three years.The average PMI reading for the second quarter as a whole was 54.3, and compares with average readings of 54.6 in the first quarter and 54.3 over 2011.”

So we see strong orders, growing employment, falling input prices, but contraction in export orders. It looks like the USA is trying to muddle through with meager growth and the rest of the world is dragging it down. Can the USA continue to decouple? For now, that appears to be the case.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.