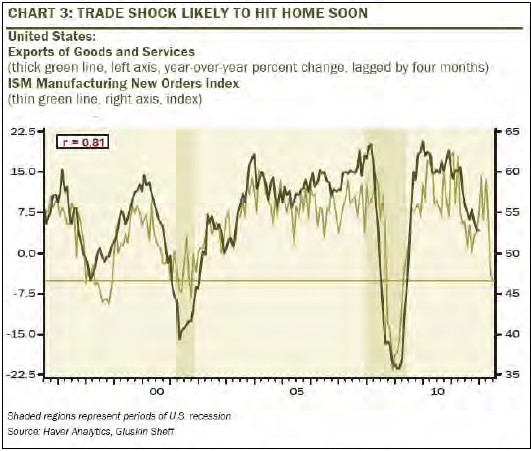

David Rosenberg has an indicator for us here that isn’t too mainstream. He says the correlation between exports and new orders could prove prescient in forecasting a recession in the US:

“I think that there may be a time, before too long, when we will walk into the office to find that they US prints a negative GDP reading on the back of a negative export shock that does not appear to be in any forecast – let alone the consensus. Look at the pattern of ISM export orders:

– April 59

– May 53.5

– June 47.5

– July 46.5

This is called a pattern. And this is a level that coincided with the two prior recessions. As the chart below vividly illustrates, there is a significant 81% correlation between annual growth in total US exports and the ISM new orders index (with a 4 month lag). So either the market has already priced this in or it is going to end up coming as a very big surprise….”

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.