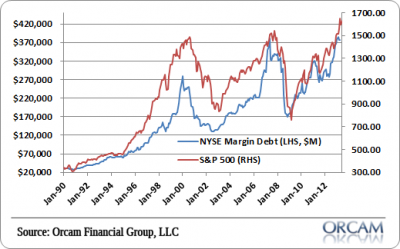

Deutsche Bank has a monster note out on margin debt that has been making the rounds. The conclusion of the note is rather simple – today’s euphoric borrowing on margin to buy stocks is reminiscent of past bubbly equity market periods (see here for more). The note reviews commentary from the 1999 & 2007 periods and compares it to what’s being said today. They found some eerie similarities:

We prepared a collection of press articles which were published around the key events during the past financial crises as displayed in Figure 2 on page 2 above. Our key finding is straight forward. Irrespective of the publishing date, the articles read alike throughout the two major crisis periods, i.e. the “new technologies market equity bubble” (1999-00) and the “Great/Global Financial Crisis” (2007-08) (see Figure 6 on page 5 and Figure 7 on page 6). Most interestingly, litrally the same content can be found in todays’ press as displayed in Figure 8 on page 7). Universal phrases include:

“A rising stock market encouraged more investors to go into debt to buy stocks, sending margin debt levels past their all-time high”.

“The National Association of Securities Dealers (NASD) has asked members to review their lending requirements in a sign of increasing concern that rising levels of margin debt could exacerbate a stock market plunch.”

“The Fed is concerned about a sharp rise in margin debt but has been unwilling to attack stock market speculation as high levels of leverage do not necessarily translate into high risk. The last time the Fed adjusted the margin rules was in 1974, when when it reduced the down payment required for stocks to 50 percent of the purchase price, from 65 percent.” […] “The Fed should return to its pre-1974 policy of actively changing margin requirements in response to stock market speculation”.

“High margin debts show the effect of over-leveraging and mispricing of risk”.

“The movements in stocks cause brokerages to stop allowing customers to buy some of the volatile stocks on margin or require clients to put up more cash.”

“Either the market rises dramatically to make those loans good or in any down move there is tremendous selling pressure”.

“Until recently, most investors ignored red flags raised by regulators”.

Why is margin debt dangerous?

Leverage is dangerous for many reasons, but the dangers of an excessively levered market are really rather simple to understand. As DB says, it creates an environment that can lead to a disorderly unwinding of excessive risk:

“Margin debt can be described as a tool used by stock speculators to borrow money from brokerages to buy more stock than they could otherwise afford on their own. These loans are collateralized by stock holdings, so when the market goes south, investors are either required to inject more cash/assets or become forced to sell immediately to pay off their loans – sometimes leading to mass pullouts or crashes.”

Margin debt creates the sort of unstable environment that makes a snowball effect much more likely than it would be in an environment without margin debt. If you recall 2008 you likely remember hearing about how many fund managers were “forced liquidators” of portfolios. That was, in large part, due to the excessive leverage.

But there’s a double whammy effect with leverage. Not only are the regulators likely to force you out of positions that go heavily against you, but from a psychological perspective it creates a much more fragile environment. If you’ve ever been short a stock you know what I mean. It’s one thing to own the stock outright in a long position. It’s a whole different mentality to borrow a position knowing that you’re PAYING to own the position. That creates a finite trading period and a sense of uneasiness that makes a levered trade much more different than outright ownership. Being on leverage is kind of like a teenager who borrows his/her mother’s car versus driving his/her own car. You don’t want to crash your own car, but you really don’t want to crash your mother’s car (because it’s not yours, there’s more on the line!).

All of this is interesting not only from the perspective of the investment world, but also from the perspective of the monetary system. I sincerely believe that this environment is due, in large part, to the Bernanke Put and the idea that you “can’t lose” by owning risk assets because the Fed will put a floor under the markets no matter what. This borrowing to own more stocks is a case of what is called a disaggregation of credit. It is, in essence, an unproductive use of credit that provides no real benefit to the real economy, but potentially adds a destabilizing element that rewards gamblers and no one else. As I’ve explained before, this is the element of QE that I simply despise. As a market practioner I know, for a fact, that this mentality influences price action and has the potential to both help (on the upside) and hurt (on the downside) the economy. I see no need to encourage such behavior and I think that’s what the Fed is doing via QE. I think it’s irresponsible and very poor risk management – something that all banks, even central banks, could improve upon.

So, are we in a 2007 or 2000 type environment? Yes. I would say we are given that the data is confirming the same sort of market trends and debt trends. But the question is what’s the trigger? The market is kind of like a Jenga set at this stage in the cycle. Everyone knows it can probably be toppled by the wrong move. But that move might not come this year, nexy year or in the next few years. As Keynes said, “Markets can remain irrational a lot longer than you and I can remain solvent.”

(NYSE Margin Debt vs S&P 500)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.