A recent note from SocGen highlights the risk of austerity in the USA. They believe the debate over the debt ceiling is likely to result in some “painful” austerity measures (Via Societe Generale):

“Debt ceiling negotiations are making progress.

Details of any agreement are unknown. It seems the Bipartisan group is tying an increase in the debt ceiling with a $4trn 10-year austerity plan to reduce the deficit. Number similar in size to the President’s Debt Commission report.

Long-term austerity plan could be a drag on the recovery.

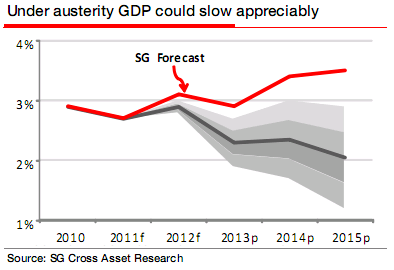

The size of the cuts would be a major drag on growth beginning 2013. If Commission’s plans were adopted: cumulative austerity measures from 2012 to 2015 should amount to around $900bn (size of necessary fiscal adjustment increasing each year). Growth and the fall in the unemployment rate would be restrained. Fed would have to lean against the fiscal winds to keep the recovery moving. Inflation and unemployment still undershooting Fed’s targets by 2015 under the austerity scenario. Fed would have to lean against the wind to achieve its dual mandate. Austerity measures necessary. But may be quite painful.”

This shouldn’t come as a surprise to regular readers. I’ve highlighted in real-time how the austerity in Greece, Portugal, Spain and the UK would result in slowing economic growth and more problems than solutions. These countries are all in balance sheet recessions and a slow-down in public sector spending results in inevitable economic slowing. Unfortunately, much of this is being done in the name of Greece. The Greeks are actually revenue constrained since they are part of a currency union and not a currency issuer. The UK and USA, however, don’t have to fall into that trap although the UK appears to be falling in as we speak. The USA has not yet succumbed, but the trend in rhetoric doesn’t look good for now.

SocGen’s estimate for GDP looks high given the recent downgrades in GDP by most of the other big banks. If austerity really starts to bite on the back of the debt ceiling debate we might all need to prepare to buckle our seat belts heading into 2013. As Warren likes to say: “because we think we’re Greece, we are turning into Japan.” As I’ve long maintained now, I couldn’t agree more.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.