Ron Paul is one of the truly honorable and honest men in Congress. I doubt that there are many in power who want better for this country than he does, but some of his talking points need to be re-framed and corrected in order to avoid confusion about the way our modern monetary system operates. In an interview this morning on CNBC he made some frighteningly inaccurate points.

The most glaring mistake he makes is his comparison of Europe and the USA. He says:

“we have a debt crisis in Europe and here. That’s why we have to cut back.”

I’ve covered this point ad nauseam, but this myth persists so it’s important to reiterate. The EMU is made up of currency USERS. The USA is a single currency system with a Federal Government (unlike the EMU). This means the USA is a currency ISSUER. If the USA wants to create money they simply spend it into existence by changing numbers in the computer system. It might sound bizarre to the layman or even the neoclassically trained economist, but the USA no longer resides in a system in which its currency is convertible into gold. Therefore, there is no such thing as a solvency constraint.

The only constraint the USA has is an inflation constraint. And while this might be a form of insolvency, it is by no means similar to what the EMU nations are undergoing. Dr. Paul is implying that the USA can spend too much and cause a “debt crisis”. This is categorically false. There is no such thing as the bond market funding our spending or holding us hostage as they hold Greece hostage. The price of our debt is controlled by our central bank which sets the interest rate via open market operations. You can call this manipulation or whatever you want, but it is an irrefutable fact that the Fed controls interest rates as the supplier of reserves to the banking system. The point is, Dr. Paul’s comparison is based on a convertible currency system (which he is an advocate of), but it is 100% inapplicable to our non-convertible fiat monetary system. Comparing the federal government of the USA and the nations of the EMU is like comparing apples and oranges.

Dr. Paul implies that we must cut back because we could have a debt crisis like Greece. But nothing is further from the truth. We could suffer an inflation crisis, but that’s a very different phenomenon than the crisis Greece is suffering from. The distinction here is incredibly important and should not be overlooked as a semantic point. Our government could certainly benefit from cutting back on some unproductive forms of spending so as to avoid potential decline in our standards of living, but to imply that we are somehow Greece or Spain is a gross misunderstanding of our monetary system.

He later says:

“you can’t keep dumping the debt on to people.”

This is another bizarre comment. Have you ever heard your Grandmother say: “Gosh I wish Uncle Sam would pay off the national debt so I could get rid of my Treasury bonds!”? Of course you haven’t. Government bonds are the equivalent of a savings account. So, when you hear people like Ron Paul talking about paying off the national debt while also complaining about how the Fed is “starving savers” via low rates, you can hopefully see the obvious contradiction in these two comments.

The deficit of the entire government (federal, state, and local) is always equal (by definition) to the current account deficit plus the private sector balance (excess of private saving over investment); see here for a more precise and detailed discussion on this. The private sector in this country owns over $10 TRILLION in government bonds. These are safe interest bearing instruments which allow the private sector to save. “Dumping” debt on the people provides them with a savings account in place of what is essentially a checking account. Now, this is not an excuse for the government to issue more debt or spend recklessly, but again, he’s making a basic misunderstanding of national accounting by implying that these bonds represent some outside constraint that makes us at risk of some solvency crisis. There is simply no such thing.

Dr. Paul has been very vocal about massive spending cuts. Joe Kernan mentions the austerity that is ravaging Europe and Dr. Paul’s response is the standard mainstream austrian econ response. Kernan says:

“you know, you’re talking about a trillion dollars in cuts in one year. You’re going to immediately hear about, you know, they tried austerity in Greece. It made things work. They tried austerity in the UK and it made things worse. The pain that people would talk about, the american public feeling with a trillion dollars in cuts.”

The pain is relatively easy to quantify given the current economic malaise. Unfortunately, Dr. Paul misunderstands our current economic crisis so he thinks the cuts are necessary due to the insolvency of the USA that is not going to occur. He says we need to cut the deficit massively in order to stave off our Greek moment. But again, this is a basic misunderstanding of irrefutable national accounting identities. If we review the sectoral balances we can see exactly how the above mentioned accounting identity looks. What you’ll notice is that the US government is pretty much always in deficit (and we have been since inception). This is because, as the currency issuer, they must make the currency available to its users before they can ever use it. So the government’s deficit is the non-government’s surplus.

So what happened when the “fiscally responsible” Bill Clinton decided to balance the budget in 1999? We can see exactly what happened. You’ll notice that he literally starved the private sector. As a current account deficit nation, our budget deficit failed to offset this leakage and directly contributed to the private sector’s deficit. This forced the private sector to tap into the banking system as their ATM in an attempt to maintain their standard of living. What ensued was one of the great debt bubbles in modern history and one of the worst periods of economic growth in American history.

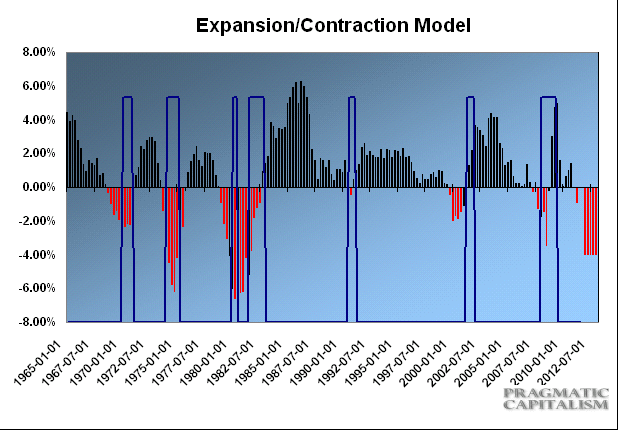

What would a $1 trillion cut do to the US economy currently? Well, we know that the sectoral balances must add up to zero ((I – S) + (G – T) + (X – M) = 0). And we all know the private sector is suffering extraordinary weakness on the back of this massive debt bubble as they de-leverage. The USA runs a current account deficit so the math is very straight forward. If all three sectors try to “tighten their belts” at the same time the economy will contract. If we assume continued weak private sector growth, continued current account deficits and a $1 trillion cut to the budget deficit in the coming 12 months my growth model looks like this:

I hope it’s becoming clear to the reader why austerity is pulverizing many of the EMU nations. They are suffering this same sort of rare recession where all three sectors are “tightening their belts”. Except, as currency users, EMU countries are unable to counteract the effects of their trade imbalance and solvency constraint. It’s a total disaster. The EMU is an incomplete monetary system without sovereignty. In this regard, it is similar to the gold standard and it is failing for the same exact reasons the gold standard failed (trade imbalances leading to solvency constraint).

Now, in fairness, Dr. Paul likely wants to see some retrenchment. As an Austrian economist he thinks the market should “clear” its excesses. But what excesses are we experiencing (aside from the obvious private sector debt excesses)? I hope I’ve already conveyed the message that we don’t have excess debt (there is simply no such thing for a sovereign currency issuer). So perhaps he believes we are suffering from an inflation problem (even though headline inflation is in-line with its historical average and core inflation is running well below average)? Either way, it seems as though his message is not being portrayed in a light that accurately reflects the realities of our modern monetary system.

In fairness, I should add that Dr. Paul makes some excellent points in this interview. Specifically, he says:

“sometimes the government spending is actually a negative.”

100% accurate. A printing press and monetary sovereignty does not give the USA the right to print in excess of our productive capacity and effectively reduce the overall standards of living of the citizens. But we have to understand that government spending is not always evil. In fact, as the currency issuer, some level of deficits (I prefer tax cuts to spending) are necessary at times. Furthermore, we must ignore these debt warnings. They are just flat out wrong. If you want to make the inflation or hyperinflation argument then let’s hear it. But scaring people about debt because of your misunderstandings of the workings of the EMU or the USA is a grave injustice to your listeners.

He continues:

“certainly I do defend those who have their head turned –screwed on right and say, yes. We’re sick and tired of the bailouts. And when corporations and banks get held at the expense of the middle class.

the poor are getting more numerous and the wealthy are getting wealthier. And they have a reason to gripe about that. But it’s not because the few are productive. It’s because the system is designed to help those who made how to lobby washington and get either regulation or the tax code written in their favor.”

I agree 100%. We should not be angry at our great innovators and wealth accumulators. We should be mad about the 0.15% of our population who trade financial products like hot potatoes and create systemic risk leveraging government money for no public purpose. And we should be furious that these banks have been bailed out with more government money in order to sustain this unproductive business. I could care less if private companies want to run speculative businesses, but the banking system in this country cannot be poisoned by greedy profit motives that lead to excessive leveraging of the system and increases overall systemic risk by causing contagion in the private banking system.

Dr. Paul makes some really excellent points in his discussion this morning, but we have to better understand our modern monetary system before we can move forward with policy prescriptions that will increase our standards of living and help get this country out of its current rut.

* See the full interview here:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.