A reader forwarded this video on to me. Apparently it’s gaining quite a bit of traction online. The video is called “The Biggest Scam in the History of the World – Hidden Secrets of Money”. Provocative, huh? As you can likely guess, the video is about Federal Reserve conspiracy theories, the evils of fiat money and of course, how you can buy gold from the person who made the video. The video is extremely well done, very convincing, provides lots of historical data and believable claims, but right off the bat I started to see some rather serious errors in the narrator’s claims. Here are just a few from the first few minutes of the video.

In the first two minutes the narrator says:

“The modern banking system creates currency far faster than trees can grow”

I’m being a real stickler for details here, but technically the banking system doesn’t actually create the currency. Banks create loans which create deposits. The deposits can be drawn down to access paper currency, but that paper currency is actually created by the US Treasury who processes orders for it from the Fed system so they can supply it to the US banking system when bank customers need it. You can read about the specifics of this process here.

Moments later he says:

“Treasury bonds are our national debt”

Right. But the national debt is also part of the private sector’s savings. If your grandmother owns a T-bond then the government has a liability and your grandmother has an asset. When discussing a credit based monetary system it’s best to understand both sides of the ledger. Otherwise, you’re missing half the picture. A credit based monetary system can be extremely unstable at times, but just looking at debt levels won’t tell you much about that. There’s much more to the accounting here.

Seconds later, he describes deficit spending as such:

“[deficit spending] Steals prosperity out of the future so it can spend it today”

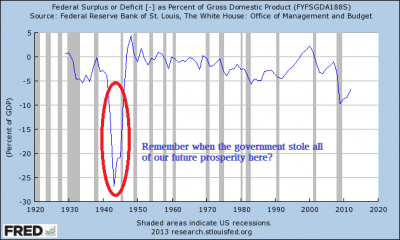

The US government has run budget deficits for the majority of its history. Just to put this in perspective, can you imagine what someone like this narrator would have said back in 1945 when the deficit was over 25% of GDP? Do you remember how the government “stole” all of our prosperity back in the 1940’s? Or did the USA undergo a massive economic boom over the 70 year period since then during which it became, by far, the most prosperous and wealthy nation mankind has EVER seen? A little common sense should make you question the claim that government spending (which has happened for hundreds of years during an extraordinary American wealth boom) necessarily steals future prosperity. Yes, government spending can have negative ramifications and isn’t necessarily always good, but there’s a bit too much hyperbole in the claim that deficit spending “steals” future prosperity. That’s just not true in all cases. The extremely high deficit from 1945 should make that abundantly clear.

Next, he’s explaining QE and states:

“This process is where all paper currency comes from”

As I described above, this is wrong. Paper currency doesn’t come from QE. Paper currency is supplied to the US banking system when bank customers have demand for it. This comes from the US Treasury and the Federal Reserve, but really has nothing to do with QE. QE does result in more bank reserves in the system, but bank reserves and paper currency aren’t precisely the same thing. For more on QE please see my primer.

Moments later he defines money in a very peculiar way so that it doesn’t include anything that doesn’t serve as a store of value. According to his definition money is a store of value, medium of exchange, unit of account, portable, durable, divisible and fungible. He then claims that gold fits this definition. But gold doesn’t fit this definition! First off, you can hardly use gold to buy anything in the real economy. Try going into Wal-Mart with a bar of gold. They’ll tell you to piss off. Better yet, try transporting all your gold around with you where ever you go. Gold doesn’t even fit his own definition. In fact, it fails almost completely in money’s most important function – as a medium of exchange.

Of course, most of our dollars don’t serve as a good store of value. In fact, holding paper currency or even bank deposits is a pretty dreadful way to try to maintain your purchasing power. Does that mean bank deposits and paper currency are not money? Of course not.

The video then goes into a money multiplier explanation claiming that banks lend out deposits and reserves. Anyone who actually understands banking knows this is wrong. Heck, even Fed employees have written about this in recent years as the crisis and QE has clearly proven that the money multiplier concept is totally false.

By this point you should see what’s going on here. The video creator displays a basic lack of understanding about banking, money and Central Banking. More importantly, you realize quickly that the video is just a sales pitch for gold and an anti government agenda. If you’re into that kind of thing then fine, but you’re being misled so be careful listening to people with such an obvious political agenda….

NB – It’s also interesting to note that the creators of this video are ultimately selling you a product. They’re selling you gold and silver as seen here on their website. And they’re using fear to drive you into that product. But look what they want from you. After countless hours of video trashing fiat money they’re asking that you pay THEM with…US DOLLARS. If this whole thing doesn’t set off a great big red flag for you then I don’t know what to say. Good luck?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

MP

Yet, you sir are also feeding your own agenda by trying to persuade others into buying your fiat financial products. Good luck!

Cullen Roche

You pretty much nailed it. I provide low fee financial advice based on a sound understanding of the monetary system and modern finance. The people who sell gold provide VERY HIGH FEE non-financial advice to try to line their own pockets by scaring people into believing their agenda about the end of the world, hyperinflation and the end of the US govt.

Dehan Sharuz

Dear Cullen,

thanks for sharing your knowledge with the world.

If i may, i would like to ask a quick question. Please do correct me if i am wrong.

My understanding is that during this hyperinflation, the dollar’s value plunges down to pennies. Which results in price increases since we now need more of that currency to buy the same. But i also learn that hyperinflation does not effect debt. Meaning usd 1000 owed still remains USD 1000 owed to the banks regardless of what the value of the dollar is.

If this is true, those who get this right, are able to buy gold now, sell at much higher prices later and get rid of their debt? And does that mean the US government can do the same with its debt? And lastly, how significantly do you think this event will effect other third world economies or thier currencies out there?

Please keep in mind, i’m no economist / banker. Just n avg. guy trying to be prepared for the worst. Would highly appreciate it if you could be kind to explain this to me

Thanks in advance.

Bryan DiMicelli

I find it a bit odd you didn’t bother to watch the entire 30 minutes, but I’ll take you on your word. I agree with your counter points here, and also find gold salesman are no better or worse than anybody selling anything else. They’ve got an angle and they’re trying to work it.

However, what I do not see here is a refutation of the idea that the gold standard was an inferior system, or that the federal reserve’s debt-based economy is in the best interest of the American people.

I see you indicating the period following the war as a time of economic success, but you ignore important details, like the manufacturing capabilities of much of the world being crippled, allowing the state’s to grow against limited competition.

I am glad you’re looking to insure accuracy in the video, but there are many other such clips pointing to the obvious flaws of a central bank. Are you here to claim you are a proponent of maintaining a central bank?