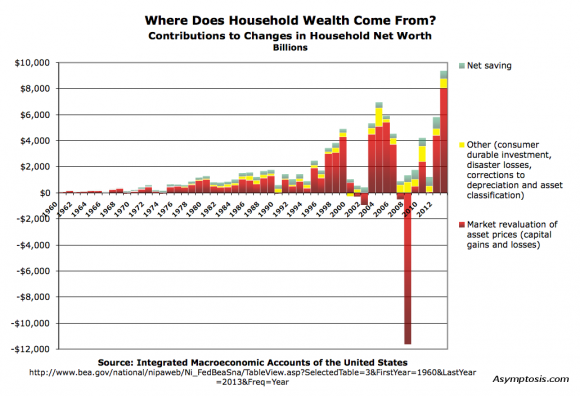

Here’s a very good post from Steve Roth over at Asymptosis which breaks down how household net worth is derived. Basically, household net worth comes almost entirely from the market value of financial assets:

That makes sense. It’s something I go into in some detail in my book. But you have to look at the aggregate accounting to understand why this is. At face value, the net worth of the entire financial asset world is zero. In fact, net worth = nonfinancial assets. Balance sheets balance so at face value the aggregate financial world has no financial asset net worth. Of course, we don’t value financial assets at face value. We value them at market value. And when you add market value into the equation then the economy has a massively positive net worth because the market values of many financial assets is well above their face value.

Why is this important? Well, when we look at saving it’s important not to fall for the fallacy of composition. When we decompose where saving comes from it becomes obvious that, in the aggregate, we cannot all “save” our way to financial freedom. That is, since one entity’s spending is another entity’s income then saving more of your income actually leads to less saving in the aggregate. As I’ve stated before, saving is not the key to financial success. In fact, investment (investment is spending for future production, not stock market “investing”, which is actually a form of allocating savings) is the key to financial success because successful investment can add not only to nonfinancial asset creation, but it can also add to the market value of financial saving. When you begin to understand this point it becomes obvious that our financial asset world is built on a foundation of output. And the quality and quantity of that output will ultimately determine how healthy our aggregate balance sheets really are. More importantly, it becomes clear that saving is not the key to financial success.

Related:

- Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance

- Saving is not the key to financial success

- Let’s talk about saving

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.