I am amazed (and disgusted) at the number of commentators, pundits and “economists” who have come out in recent days to explain to the world how this human tragedy will result in a Japanese fiscal crisis. The people pushing this story are are the same ones that have been telling us America is bankrupt for the last 10 years and would have gone bankrupt 100 times over by shorting the Yen and JGB’s over the last 20 years. These pundits have been confounded for decades yet they never seem to lose credibility and never stop to consider why their thesis isn’t panning out.

In essence, these pundits say Japan is on the brink of a bond market collapse that will result in the inability of the government to finance its debt which leads to a Greek scenario. Of course, what these people fail to recognize is that Japan is fundamentally different from Greece in that Greece is a currency user and Japan is a currency issuer. Whenever someone compares Japan or the USA to a Euro nation you should immediately dismiss them and stop reading their content – they clearly do not have even the most basic understanding of monetary systems.

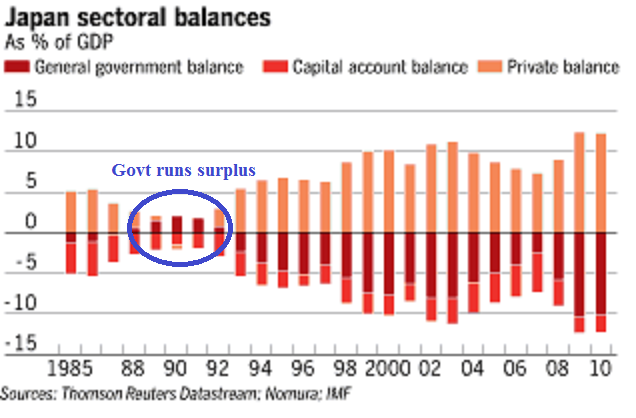

This is not to imply that Japan’s spending policies have been the right approach over the last few decades. Japan’s policies over the years have been terribly misguided. Much like our own policies are currently misguided. In the late 80’s Japan experienced dual bubbles in real estate and equities on the back of a stellar period of growth. They had deregulated their banking system, allowed their economy to become financialized and to top it off their government decided it was wise to take advantage of this period of stellar economic growth by running a budget surplus to “get their financial house in order”. In essence, this was almost exactly what the United States did in the years running up to our own dual bubbles.

Like the budget surplus in the USA in 1999 the surplus in Japan exacerbated the private sector debt problem as the public sector surplus resulted in private sector deficit. This ultimately resulted in en epic bubble collapse. Their solution was less than precise. Rather than take the Swedish approach the Japanese decided to let their banks earn their way out of the crisis. This only prolonged the inevitable deleveraging. This was combined with insufficient budget deficits that would have allowed the private sector to deleverage more quickly. This debt deleveraging resulted in anemic economic growth and persistent deflation. What ensued was a series of start and stop recessions and recoveries that happened to overlap with a difficult period of economic growth in many other parts of the world. As we all know it hasn’t been a pretty picture.

If all of this sounds familiar it should. America is suffering the exact same thing as we speak. But this confounds the hyperinflationists and defaultistas. They just can’t understand why this spending isn’t resulting in inflation and/or bankruptcy in Japan. The problem is, these pundits are working under a defunct model. They are assuming that a nation with endless supply of currency can run out of money and become insolvent in the same way a household, business or Euro nation can. The truth is, Japan can never run out of Yen. They can cause a collapse in their currency in the form of hyperinflation by printing Yen far in excess of productive capacity, but that’s clearly not happening. Japan is still struggling to battle deflation….

But none of this stops the pundits from using this tragedy to try to push their political agenda. Facts aren’t necessary for these people. If they can grab your attention via simple analogies and scary rhetoric they don’t need facts – they have won the second that you allowed yourself to be scared into listening to them. But the facts don’t lie and the facts say Japan is neither close to bankruptcy nor close to hyperinflation. Let’s review some facts.

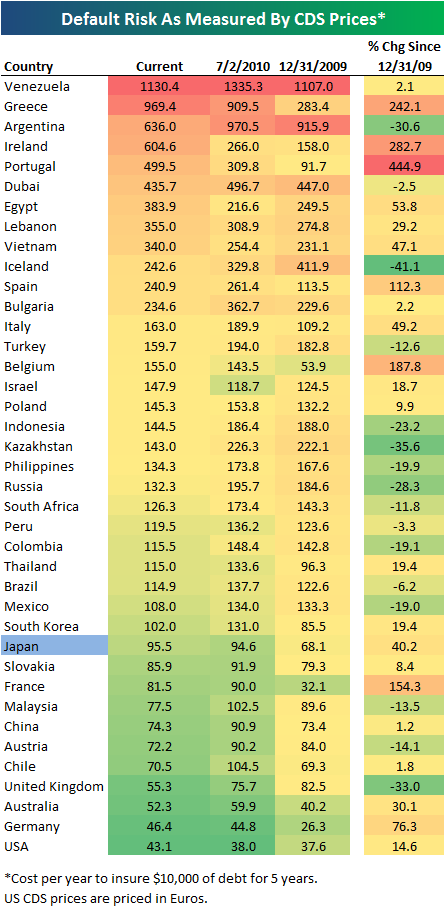

There is, arguably, no better measure of a nations solvency than CDS prices. If you review the recent change in Japanese CDS you’ll notice that they are remarkably low considering the size of their public debt. You’ll notice that Greece and Ireland are more than 6 times higher than Japan currently (via Bespoke):

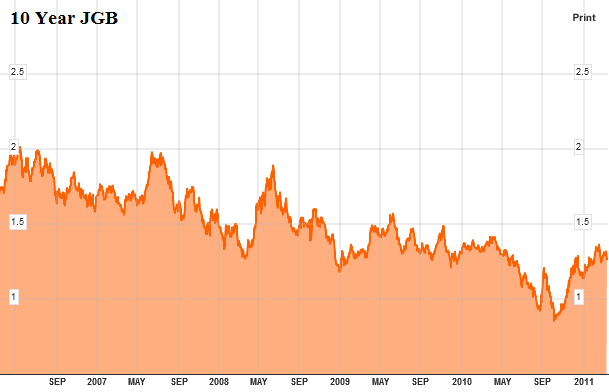

What about their bond market? If you’ll recall the solvency crisis last year in Europe one of the defining characteristics of risk was surging yields. As I often say, there really are bond vigilantes in Europe. If there are vigilantes in Japan they sure are asleep on the job. Just look at Japan’s 10 year bond at 1.2%! It has actually declined in recent weeks. Investors clearly aren’t concerned about solvency. And rightfully so. There is no such thing as Japan running out of Yen.

(10 Year JGB Yield)

Make no mistake. Despite this horrible human tragedy Japan is a strong and stable nation. Their people are hard working, disciplined and remarkably innovative. Their economy is stable, dynamic and diverse. They are not bankrupt and they would welcome some inflation. The USA is in a very similar position. Thus far, we have walked a tightrope through this balance sheet recession without allowing the fear mongerers to scare us into austerity. As we can see in Ireland, Spain and Greece the austerity approach has been nothing short of disastrous.

Our approach has been far from perfect. We should have forced our banks to take more pain. The response should have been focused on Main Street and not Wall Street. The Fed’s powers and involvement in the markets should have been reduced rather than increased. But this doesn’t mean we need to convince ourselves that the entire recovery response has been a failure. In fact, a simple accounting identity shows that the government budget deficit is the only thing keeping us from sinking back in to recession. As I’ve said before:

“The deficit of the entire government (federal, state, and local) is always equal (by definition) to the current account deficit plus the private sector balance (excess of private saving over investment).”

“Since we are running a -3% current account deficit the government MUST spend to the tune of 3%+ of GDP if the private sector desires to save. And that’s exactly what is occurring. In fact, the 10% deficit is allowing the private sector to save quite a bit (roughly 7%). Make no mistake, the deficit spending of the last 2 years is what has generated recovery.”

Japan made the mistake of starting and stopping their stimulus at a time when the private sector was deleveraging. This only exacerbated their problems and ultimately resulted in a kick the can strategy. If there is one thing that we can learn from Japan it is that we are not going bankrupt and we are not suffering hyperinflation. And if we make the mistake of Japan, by stopping and starting the deficit spending during a balance sheet recession we will certainly slip back into the abyss. There’s a lesson to be learned from this human tragedy – don’t be scared into believing everything you read about our nation’s imminent bankruptcy. If we allow ourselves to be scared into believing we are insolvent we’ll soon find ourselves suffering our own human tragedy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.