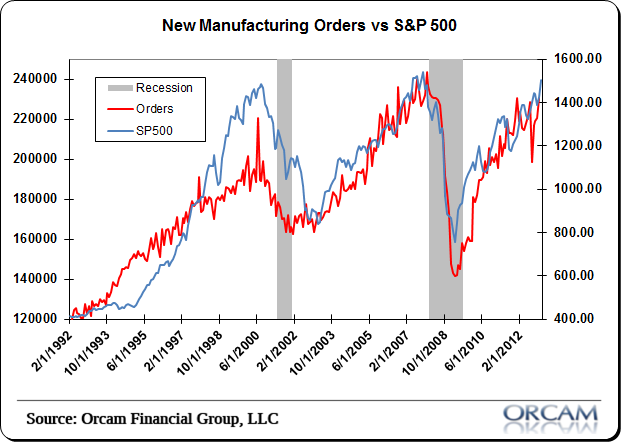

Another strong reading in durable goods orders this morning. This is important for two reasons:

1. It confirms the recent strong PMI readings we’ve seen from the Markit PMI reports in the USA.

2. Durable goods tend to have a very strong correlation with the S&P 500 (see chart below).

Econoday has the details on today’s report:

Manufacturing may be regaining momentum. While civilian aircraft added huge lift to December durables orders, gains were broad based. New factory orders for durables in December jumped a monthly 4.6 percent, following a boost of 0.7 percent in November. The median market forecast was for a 1.6 percent increase. The transportation component spiked 11.9 percent after a 0.5 percent dip in November. Excluding transportation, durables orders increased 1.3 percent, following a rise of 1.2 percent in November. The consensus called for a 0.4 percent rise in orders excluding transportation.

Outside of transportation, component increases were led by primarily metals, up 3.6 percent, and computers & electronics, up 3.3 percent. Also rising were fabricated metals, machinery, and “other.” The only negative component was electrical equipment, down 2.4 percent.

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.