I guess we have to get used to living in a “what have you done for me lately world”, huh? With high frequency trading, the 140 character Twitter world and attention spans about as long as a gnat’s, it looks like policy makers are increasingly being impacted by this societal change in the way we think. And I think there’s a bit of this going on in Europe as we speak and it’s having a massively negative impact on millions of people’s lives. Let me elaborate.

Every fix implemented in Europe thus far has been a band-aid on a gushing wound. And after brief periods of relief the negative long-term trends become acknowledged once again, the structural flaws reassert themselves and markets relapse. This has been the trend in Europe for years now and I don’t think it’s over yet.

As regulars know, I think the problems in Europe require long-term thinking. We need to fix the currency crisis that is causing the solvency crisis at the sovereign level. So we need one of two things to occur – a complete break-up of the Euro (very unlikely in my opinion) or a move towards some form of fiscal union (the likely direction). We have to return Europe’s nations to a state of sovereignty. Ie, we need to eliminate the solvency crisis by creating some form of supranational entity that can always procure funds like we have in the USA (see here for more on how the US states are like Europe’s countries and why US states are experiencing a funding crisis).

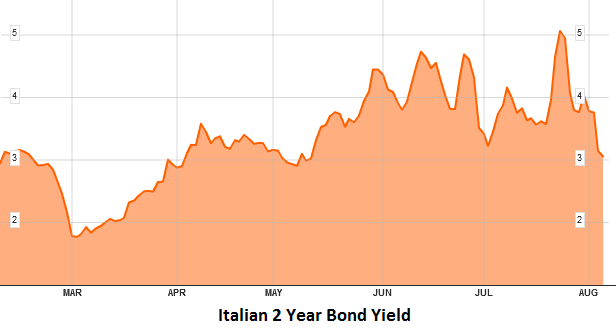

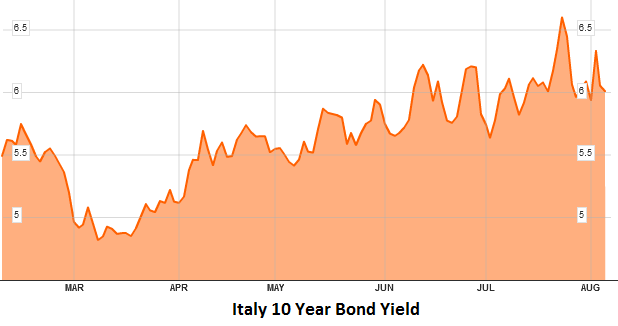

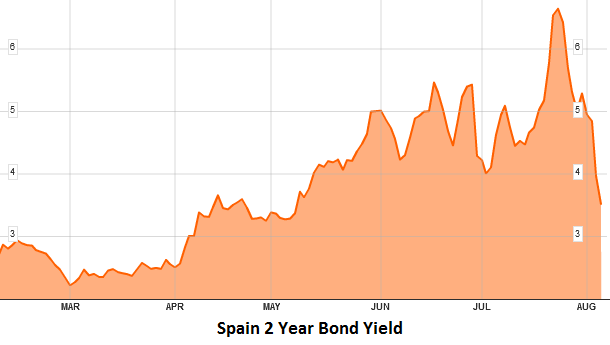

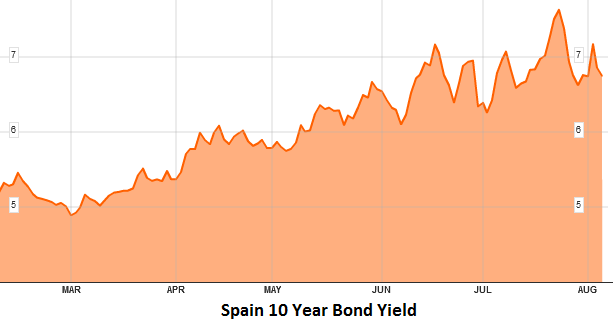

And one of the better indicators of persistent crisis in Europe over the years has been bond yields. And to view this short-term perspective just take a look at the 2’s versus the 10’s in Spain and Italy:

The 10’s have barely moved while the 2’s have collapsed. In other words, the long-term perspective on solvency has barely budged while yields at the short-end are cratering. What does that tell us? It tells us that bond vigilantes don’t think this crisis is close to being over yet. And given the lack of structural fixes, I think they’re right. The latest jaw boning from the ECB seems to have calmed markets for now, but let’s see if that buys them time to actually implement a long-term fix. If recent history is any guide, this is likely another case of short-term thinking for a long-term problem.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.