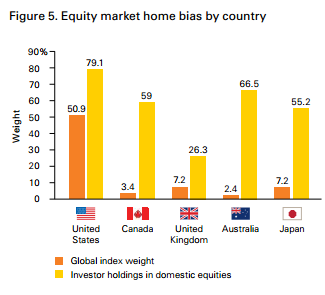

Here’s an awesome chart from a recent Vanguard research piece:

What this chart is showing is that every country has a home bias. So, if you’re an American investor you tend to hold mostly domestic stocks. If you’re a Japanese investor you tend to hold mostly Japanese stocks. So on and so forth. And what’s crazy to think here is that you’re literally just buying stocks from one country because you were born there and for whatever reason, you think that’s the only country whose stocks you should own. Of course, we should know better.

The empirical research (see Aness 2011 & Vanguard 2006) clearly shows that international diversification works. And it works for the same reasons that domestic diversification works. Basically, by owning a bigger pool of assets you reduce specific risks within your domestic economy such as domestic economy risk and currency risk.

A great example of this is Japan. One of the great worries every investor has is falling into the Japan trap where you undergo 20 years of stagnant or negative returns. As I noted in “The Importance of Global Asset Allocation“, it’s imperative that investors diversify abroad to avoid such a risk. Yet almost every domestic investor has an overweight in their domestic economy.

It just shows that irrational investing persists despite the well founded empirical evidence that shows how risky home bias can be.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.