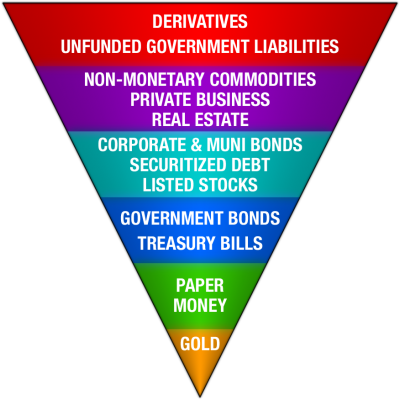

I had never seen this before, but a reader pointed out a concept that is often used by gold bugs to promote the idea that gold is the ultimate safe haven. It’s called “Exter’s Pyramid” and is named after a former Fed official named John Exter.

Here’s how Wikipedia describes the concept:

“Exter is known for creating Exter’s Pyramid (also known as Exter’s Golden Pyramid and Exter’s Inverted Pyramid) for  visualizing the organization of asset classes in terms of risk and size. In Exter’s scheme, gold forms the small base of most reliable value, and asset classes on progressively higher levels are more risky. The larger size of asset classes at higher levels is representative of the higher total worldwide notional value of those assets. While Exter’s original pyramid placed Third World debt at the top, today derivatives hold this dubious honor.”

visualizing the organization of asset classes in terms of risk and size. In Exter’s scheme, gold forms the small base of most reliable value, and asset classes on progressively higher levels are more risky. The larger size of asset classes at higher levels is representative of the higher total worldwide notional value of those assets. While Exter’s original pyramid placed Third World debt at the top, today derivatives hold this dubious honor.”

Of course, Exter lived in a very different era than today and one where gold played a much more significant role in the global economy than it does at present. So it’s not surprising that Exter viewed gold as being totally unique.

I would argue that the pyramid is probably wrong today with regards to gold. I’d argue, that in a true fiat system, the nation or nations with the largest output backing its currency or currency system is the global safe haven. And I think recent history proves this is true. After all, when the sh*t really hit the fan in 2008 it wasn’t gold that rallied. It was the USD relative to other currencies as well as US government debt. Gold, on the other hand, actually declined by 20%+ at points during H2 2008.

Of course, this doesn’t mean gold isn’t viewed as a safe haven at all. It just means that without a gold standard the price of gold is a lot less stable than some might presume….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.