One of the main points I always make during my active vs passive rants is that asset picking is becoming the new stock picking. You see, it used to be that alpha chasing active managers would pick stocks. The sales pitch was “I have a unique talent that will allow me to pick the best stocks so pay me a high fee to do that for you.”. That turned out to be a load of crap so the world changed a little. These alpha salesman then started saying that asset allocation was the best way to achieve alpha. They ran some backtests, identified certain sectors that perform well and then packaged funds to benefit from these sectors. Except that turned out to be crap also.

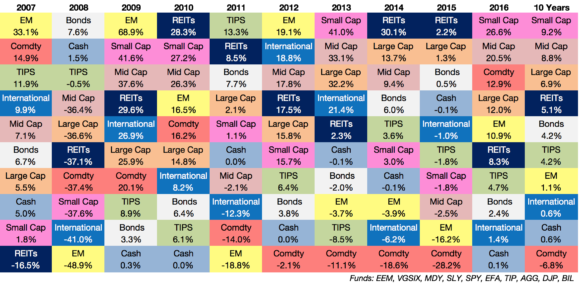

Here’s a great chart showing the crap shoot that is asset class picking:

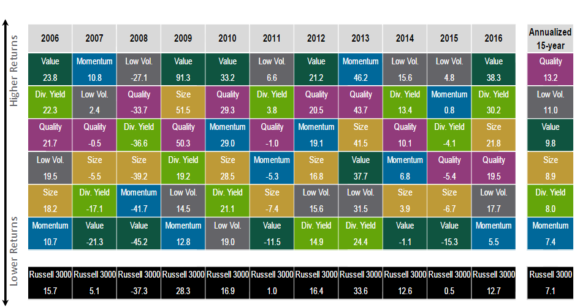

Yeah, good luck picking the best performers there from year to year. But the latest evolution in the alpha sales pitch is the factor investing chase. And here’s a great new image from Northern Trust (thanks to Barry Ritholtz):

Looks an awful lot like the asset class image above, huh?¹ Except there’s one big difference. At least with the sectors we know which sectors are which. For instance, I know what cash is and what its future returns will be. I know that commodities are cost inputs in the capital structure that should have low real returns over long periods. I know that current bond yields are a good predictor of future returns.

But when it comes to factors we don’t really know what the future of these baskets will look like or if they will look remotely similar to what they do today. For instance, what yields a high dividend today might not yield a high dividend in 5 years. What has momentum today might not have momentum tomorrow. What looks like quality today might look like crap tomorrow. In other words, predicting factors isn’t just identifying known sectors of the market. Factors are moving targets that require an even greater degree of asset forecasting than sectoral picking. And I’d argue that this chart actually makes the dispersion look better than it really is since it’s easy to identify factors in a rear view mirror than it is to identify what stocks will actually perform like these factors in the future.

The asset management business does a wonderful job of taking really simple things and overcomplicating them in the name of trying to provide value. But asset allocation is one thing where simplicity tends to trump complexity.

¹ – It’s important to note that these returns are not adjusted for risk, taxes or fees when compared with the Russell 3,000. As I’ve shown in a previous post the real-time track record of these factors is mixed at best and shows that some factors can underperform for long periods of time. This means that factors need to be diversified. But this begs the question – “if I need to diversify factors which makes my portfolio necessarily resemble a market cap weight then why not just buy the market cap weight and remove the guesswork?”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.