Scott Sumner has a post up today that says “debt surges don’t cause recessions“. I think this is a lot like saying that eating a lot of food doesn’t make you fat. Of course, there are lot of variables that go into getting fat, but consuming a great deal of food is generally a pretty good way to get started down that road. Food’s a vital component of our lives so it’s not that food is inherently evil, but it can be easily abused. Anyhow, here are my thoughts on why debt does in fact cause recessions or at least substantially increase the odds of future recession:

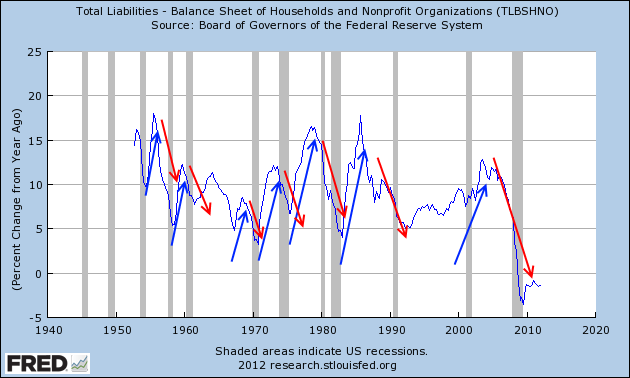

1) Economic booms are generally associated with debt booms. Since bank money (what MR would call “inside money”) is the primary form of money in our fiat monetary system it’s perfectly normal for loans to increase as economic activity increases. People buy more things, invest, etc. Figure 1 below shows that the rate of change in liabilities increases during economic expansion. I think we’d all agree that’s to be expected.

2) Sometimes the boom gets out of control. Humans are irrational. So there are times when the boom turns into a big boom. Why? It can be any number of varying reasons, but let’s take the last housing boom as an example. Households and Wall Street began to believe that house prices could never decline in value. As the housing boom picked up this looked like a sure thing for everyone involved. The banks could sell more houses, households could speculate and flip houses and Wall Street could repackage all these AAA rated mortgages and resell them to their friends. It was a win-win. The boom starts to get out of control. Stability becomes destabilizing.

3) A bust requires a boom. The economy is cyclical by nature. And stability can be destabilizing. During the housing boom these irrational agents went overboard. Lending standards got too lax and too many homes were sold on the premise that low credit borrowers could pay it back. And when the bust occurred the economy went with it. Asset prices decline, people start losing their jobs, defaults pick-up, etc. The boom turns into a bust. What was so dangerous about the housing boom was the substantial decline in asset values. The housing market was the key asset from which trillions of different products were priced. So when the housing bubble burst we began to see imbalances all over the economy. Suddenly, bank assets were worth a lot less than they presumed and households were unable to afford houses they had purchased. And this all starts with the issuance of credit which made the housing bubble possible in the first place. After all, if people could have afforded the houses they purchased on credit we would have never had a housing bust to begin with!

4) So what do we find here? Since bank issued “inside money” is the primary form of money used in our fiat monetary system it’s totally normal and expected that a boom would result in credit expansions. As you can see in the chart below the rates of change in total liabilities tend to boom and bust with the business cycle. And this shouldn’t be at all surprising. When the economy booms people borrow more as they do more business, take more risk, etc. And when the boom slows and turns into a bust the credit cycle flips and the downturn ensues. Like food, we need credit expansions. But it’s when the credit cycle gets abused that we see the biggest booms and busts.

The bottom line to me is, you can’t even begin to understand the current economic machine without understanding this basic fact – we live in a fiat monetary system in which bank issued “inside money” is the primary form of money. Access to credit can exacerbate the boom as we just saw during the recent period of lax lending and unusual optimism. And the more credit the more potential for a boom (and a bust). So I wouldn’t say that rising debt levels always cause recessions, but rising debt levels certainly make it easier for economic agents to act irrationally and irresponsibly thereby substantially increasing the odds of a boom and a bust.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.