With everything that’s going on in Europe and the continuing political charade in America, you might easily be distracted. But there’s another far more important story developing in other regions of the world. And in my opinion, it’s as important and perhaps more important than these other headline grabbers out of Europe and America.

In the last few months we have seen a persistent weakness in trends out of the BRIC nations. This is important because the countries have been the one truly strong leg in the global recovery. This has been nowhere more apparent than in corporate earnings. While domestic revenues have remained flat to down, international companies continue to experience strong growth on the back of this growth. But the trend appears to be changing.

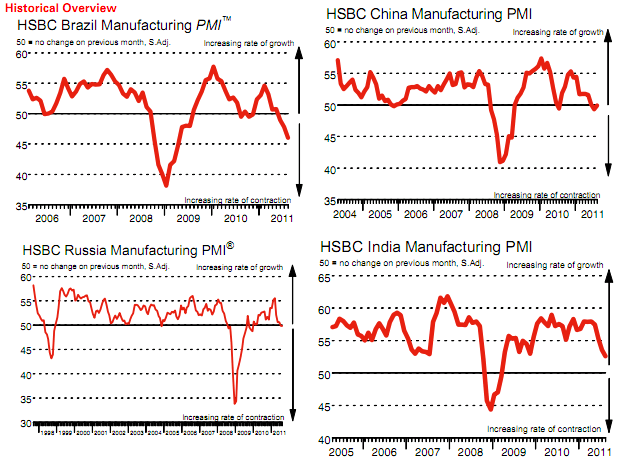

If we look at the most recent PMI data from all four nations we can see how different this slow-down is from the scare in 2010. It’s deeper in all regions (except China). Brazil, Russia and China are already in contraction mode and in the case of Brazil it’s quite deep at 46. India’s PMI readings are still on the expansion side, but at levels seen just 2 times in the last 6 years.

This has hit markets hard in recent weeks and commodity markets in particular as they tend to be BRIC sensitive. I believe investors would be wise to heed the risks in the commodity sector, but also keep an eye on commodity prices as they’ve proven to be a fairly good real-time indicators of future expected economic worries in these parts of the world.

This is the primary exogenous risk to the US markets at this juncture. If the BRIC countries were to experience a substantive and sustained recession, Europe and the USA would suffer mightily as they continue to struggle with their balance sheet recessions. This is a story that needs greater attention as Europe and the USA steal the spotlight. This is just one more piece in an already worrisome global economic puzzle.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

arbie

could get ugly..