They say that Alcoa kicks off earnings season, but that’s not true in my opinion. The most important earnings report of the season is always FedEx and they’re always one of the first to report. Today’s report is no exception. FedEx is currently an excellent barometer of the global economy and the picture for corporate profits.

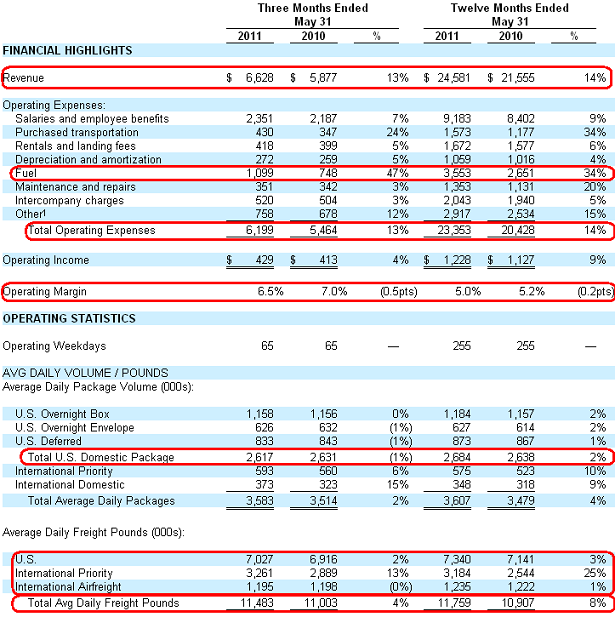

They reported their Q4 and full year results with revenues jumping 13% in Q4 and 14% for the fiscal year. Fuel prices dinged their margins a bit in Q4. Overall, they sounded moderately upbeat:

“With this positive momentum, moderate economic growth and subsiding cost headwinds, FedEx is well positioned to deliver strong earnings growth in fiscal 2012.”

Their guidance was positive with FedEx now expecting substantial increases in 2012 EPS and CapEx:

“FedEx projects earnings to be $1.40 to $1.60 per diluted share in the first quarter and $6.35 to $6.85 per diluted share for fiscal 2012. This guidance assumes the current market outlook for fuel prices and continued moderate growth in the global economy. The company reported earnings of $1.20 per diluted share in last year’s first quarter. The capital spending forecast for fiscal 2012 is $4.2 billion, which includes the delivery of aircraft as well as progress payments toward future aircraft deliveries, along with investments in facilities, vehicles and information technology in support of the company’s global growth strategy. The company will benefit from the tax expensing/accelerated depreciation provisions included in the Tax Relief Act of 2010 passed last December.”

If we drill down into the 8k we can see a nice snapshot of the global economy:

So, domestic growth is very weak while international growth is generating enough growth to keep profits strong. They mention that the package growth is led by Asia so the Chinese recovery remains the linchpin in this entire equation. Obviously, Europe is weak and the domestic package data shows a very weak economy. Overall, it’s still a pretty terrible picture for the domestic US economy, but the profit story remains pretty much the same as it has the last few quarters. International growth is driving just enough demand that firms can report solid profits while slowly deploying capital into a moderate growth period. Margins remain high because companies have slashed payrolls and other expenses. Overall, it’s an environment where the domestic economy will continue to appear very weak and corporations with a strong international reach will continue to perform fairly well.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.