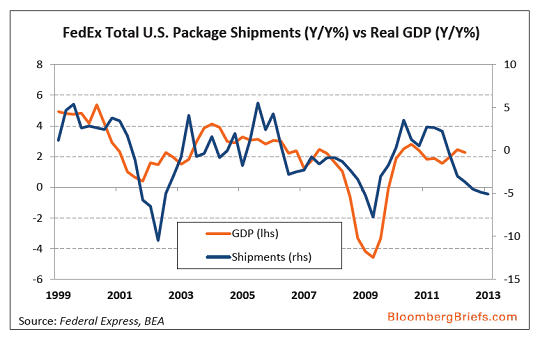

Interesting data point here via Bloomberg Economics Brief:

CHART OF THE DAY: From today’s “Bloomberg Economics Brief,” Bloomberg economist Rich Yamarone releases a chart showing that FedEx’s total U.S. package shipments may indicate a bleak outlook for economic activity. Is a recession in the cards?

Federal Express Cuts 2013 Profit Forecast on Economy, Fuel

FedEx Corp., an economic bellwether as operator of the world’s largest cargo airline, reduced its profit outlook for the second time this year, citing a slower economy. The shipper said its “2012 U.S. GDP growth forecast is 2.2 percent and 1.9 percent for calendar year 2013, which is 0.5 points lower than our fourth-quarter earnings forecast.” “Exports around the world have contracted and the policy choices in Europe, the U.S. and China are having an effect on global trade,” Fred Smith, chief executive officer of the company, said. The company’s ground-delivery business in the U.S., which offers a less expensive alternative to air delivery, posted a sales increase of 7.9 percent to $2.46 billion.

— Richard Yamarone, Bloomberg Economist

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.