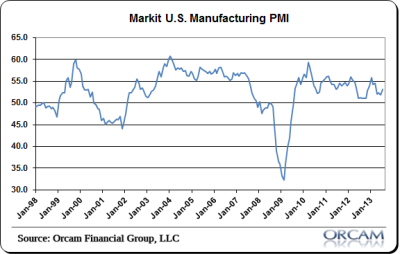

The real-time composite proved right as this morning’s Flash PMI report came in showing slight improvement in the overall data. The overall index was up to 53.2 from 51.9 in June. Econoday has the detais:

“Markit’s US manufacturing sample reports solid monthly growth so far in July with the composite index at 53.2, up from 51.9 in the final June reading and compared with 52.2 in the mid-month June reading. New orders are very positive, at 55.1 to show the best monthly growth since March. New export orders are a standout, at 52.3 for a big 6 point gain that points to a rebound in global demand. Backlog orders are also up as is output and, importantly, employment.

Other readings include a drop in inventories that, given the rise in orders and output, points to the need for inventory restocking which will be a plus for future output and employment. Input prices are up in line with increases underway in fuel prices, which may also be a plus given concern among Federal Reserve doves that inflation right now is too low.

This is a good report that extends the run of mostly positive signals from the manufacturing sector which continues to rebound following flat conditions in the early spring. Today’s data will boost expectations for strength in next week’s ISM manufacturing report. Yet whether today’s report will be a plus for today’s session is uncertain given the touchy play underway between economic strength and expectations for Fed tapering.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.