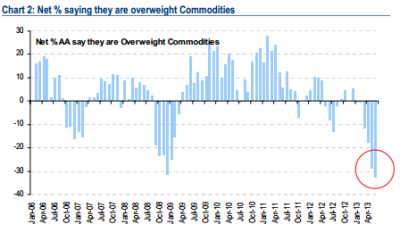

Interesting data point this morning from the Merrill Lynch fund manager survey showing the extreme hatred for commodities at present (see figure 1). I’ve always hated the idea of “investing” in commodities so it’s interesting to see these extreme swings in sentiment. I basically think the chart below should show a negative blue bar across the entire timeframe.

Anyhow, this could be a contrarian sign or it could be the beginning of what I hope is a big change in the way managers view commodities. I think Wall Street has spent the last 15 years selling the concept that commodities are a good way to diversify your portfolio. They’re non-correlated inflation hedges and all that. The reality is that commodities perform horribly over the long-term in real-terms. They’re not an inflation hedge at all. And they provide non-correlation alright. So long as you’re looking for something that has non-correlation with going up.

I won’t regurgitate what I’ve said in the past about commodities so see here if you’re interested in more of my thinking here….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.