The Federal Reserve prefers not to focus on inflation within the energy and food segments, but that doesn’t mean they’re not important. They’re just volatile components that can lead to erroneous conclusions about the broader index. And boy have they been volatile in recent years.

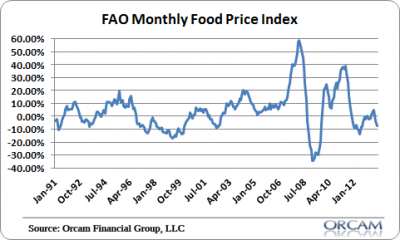

After huge increases in 2007/8 and 2010/11 food and gas prices are now declining rapidly. According to the FAO global food prices are now deflating at a -7.7% year over year rate:

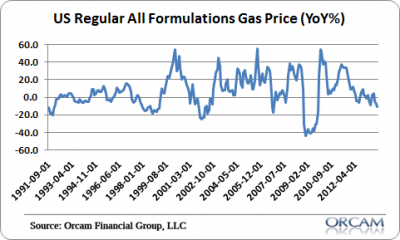

And gasoline prices are now deflating at a -10.7% year over year rate:

On the bright side, this should shore up some consumer spending for other things. And it should give Austrian economists some time to stop shrieking about the conspiracy theory at the BLS so they can go buy more gold to stock their bunkers with. Not that I would recommend that, but that seems to be the portfolio strategy du jour for that particular breed of conspiracy theorist. I think I just exceeded my snark level. Sorry.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.