This morning’s global PMI readings were a mixed bag on the whole, but showed mild improvement. Notable improvements came from the EMU, USA and China.

The EMU is clearly still in recession, but showing signs of modest improvement as the PMI moves from 45.8 to 46.2. This is still a contraction, but we’re seeing some stabilization if nothing else. The USA’s Markit PMI improved to 52.8 from the October reading of 51. And China showed some mild improvement to 50.5 – its highest reading in 13 months.

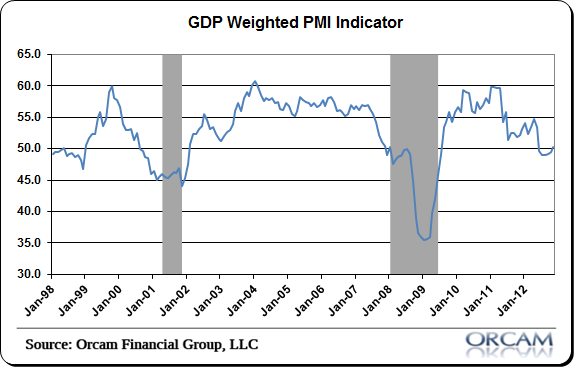

The globally weighted GDP index (updated monthly at Orcam Investment Research) moved up to 50.3 from 49.4. This is the first expansion reading since May of this year.

(Source: Orcam Investment Research)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.