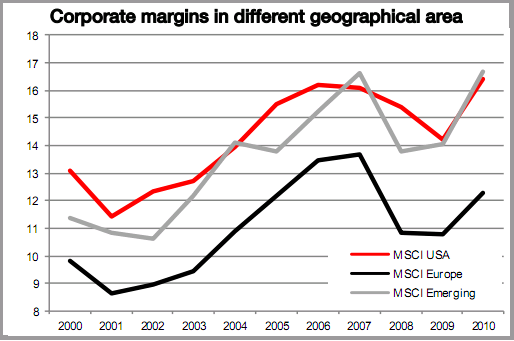

The saving grace for the US equity markets over the last few years has been the strong corporate profit picture. Despite stagnant domestic recovery, massive cost cutting, high fiscal deficits and strong emerging market growth has been enough to bolster equities. And its not just a US story. Margins, for instance, have been improving around the globe.

In a recent note, Societe Generale discussed this phenomenon and the risk associated with record high margins – there’s generally only one direction to go….SG says the tightening cycle in many emerging markets is likely to pressure margins.

“Are corporates strong enough to maintain positive earnings trends despite the macro environment?

Apart from Europe where we still see some countries facing recessions, corporate margins are at historical highs. We could now fear that some corporates start to struggle to maintain such high margins, specifically in emerging markets as central banks continue on their tightening cycles.”

Ironically, in the USA, further economic weakness could lead to even further cost cuts as US corporations layoff workers. This could actually bolster the corporate profit picture if domestic growth remains stagnant and emerging markets remain strong.

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.