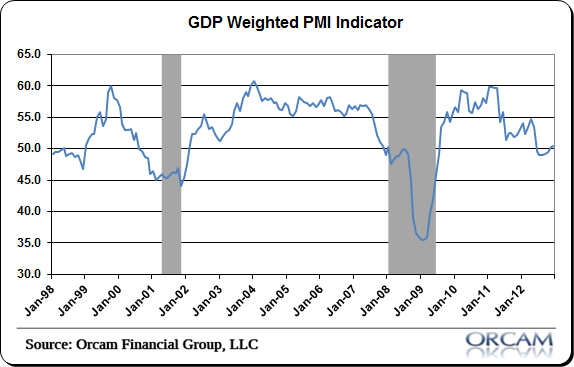

The final PMI readings for December are in and it points to a modest improvement in global economic conditions. Notable improvements came from the USA which registered at 54, India at 54.7 and China at 51.5. Notable weakness remains in Europe which is clearly still experiencing a very difficult economic environment. The Eurozone PMI came in at just 46.1. The recession in Europe persists.

Here are some of the more notable data points:

- EMU: 46.1

- USA: 54

- China: 51.5

- India: 54.7

- Japan: 45

- Russia: 50

- Brazil: 51.1

(Source: Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.