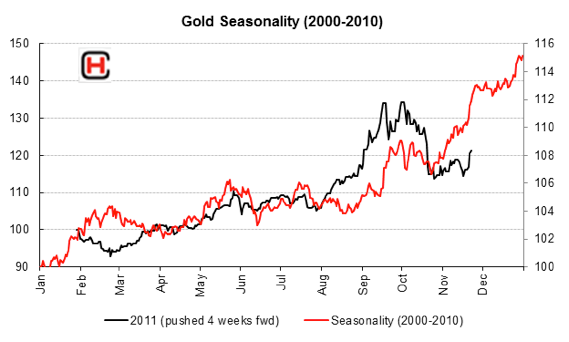

Ben Davies, founder of Hinde Capital, was recently on King World News to discuss his outlook for the gold market. Davies is wildly bullish about gold and has a fairly similar perspective on the metal as I do. He sees two of the primary drivers of gold being demand from China and the Euro crisis which is being perceived as a failure of fiat currencies. But Davies is also focused on a seasonal driver in the near-term. Since he believes we are in an environment that is consistent with the last ten year (easy Fed, negative real rates, strong demand from China, etc) he believes the seasonal trends should hold true. Davies says:

“You really don’t need to say much when you look at the chart, it’s extremely bullish. We took the current year and pushed it forward four weeks to adjust the seasonality. We realized that the market was working on a four week basis ahead of time and if we adjusted the seasonality by bringing it forward four weeks, readers can see that come October we were going to actually have a rally into the year end. Historically you would tend to see a dip in October, but we already had that dip in September.”

Source: King World News

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.