Goldman Sachs says there is a strong likelihood of inflation slowing in the coming year. And this means the Fed is likely to try to create more inflation via further QE. In a recent note they said:

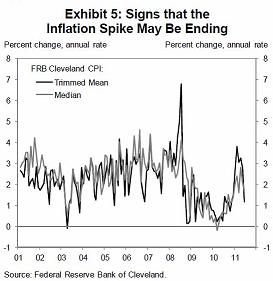

“The weaker data on economic activity have clearly raised the probability of renewed monetary easing by the Federal Reserve. In his monetary policy testimony this week, Chairman Bernanke’s main argument against renewed easing was that inflation is now significantly higher than it was in the summer of 2010. Indeed, the core CPI for June released on Friday showed a pickup in the 6-month annualized inflation rate to 2.5%, clearly above the “mandate-consistent” rate of 2% or a bit less. However, we may well have seen the highest inflation figures. Exhibit 5 shows that underneath the surface, both the “median” and “trimmed-mean” indexes—statistically based measures of underlying inflation that may be preferable to the better-known core CPI—showed a notable slowdown. Therefore, we still expect core inflation to slow substantially on a sequential basis over the next year.

Moreover, if the economy returns to recession—not our forecast, but clearly a possibility given the recent numbers—Fed officials would undoubtedly ease anew even if inflation is close to their target. Indeed, Chairman Bernanke laid out the possible options for such a move in his monetary policy testimony this week, namely a change in the forward-looking language in the FOMC statement, a cut in the interest rate on excess reserves, and—last but certainly not least—an increase in the size and/or composition of the Fed’s balance sheet.”

This is accurate in my opinion and really gets to the heart of why the Fed’s policies are so misguided. Because QE does not alter net financial assets it does not actually alter the private sector’s economic standing. Therefore, referring to QE as “stimulus” is entirely wrong. All QE has been proven to do is alter nominal asset prices via psychological channels. And while there are broad beliefs that this generates a “wealth effect” the most recent bout of QE confirms my original beliefs that QE would be a monetary non-event and would instead serve as a margin squeeze on the entire economy as the Fed does indeed help create higher cost push inflation which actually resulted in lower real GDP….Furthermore, we all know, after 20 years of the Greenspan and Bernanke put, that the Fed can help further financialize the US economy by keeping asset prices higher than they otherwise would be. Unfortunately, because we haven’t learned form our past mistakes, we continue to repeat them….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.