This recent note out of the Goldman Sachs Investment Strategy Group is likely to wrinkle some feathers in the world of gold investors. Goldman sees gold as an increasingly poor investment going forward. They expect a stronger dollar, US economic recovery and rising risk assets to serve as an impediment for what is generally viewed as a hedge against fear and inflation (although Goldman argues that gold is not really a hedge against either).

Although I agree with much of the Goldman piece, I have tended to view gold as a hedge against fears that the Euro crisis (fears that the Euro is a flawed fiat currency) will deteriorate and that the Fed will be viewed as an incompetent “money printer”. Of course, there is much uncertainty and debate regarding these issues, but one thing appears certain – neither issue is going away any time soon. In addition to these psychological components is the very real demand from Asia. While the developed world grapples with disinflation the emerging world has a very real inflation problem and it has only contributed to increasing gold demand. The FT reported last week:

“Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. “The demand is unbelievable. The size of the orders is enormous,” said one senior banker, who estimated that China had imported about 200 tonnes in three months.”

As I mentioned last year, this is a very real fundamental driver of gold prices. When will it end? Well, with China looking less than serious about fending off inflation it is likely that the fears of high inflation could persist. All in all, I believe it is safe to assume that the epic run in gold is not yet over, however, as we near the Euro endgame and the Fed’s QE2 and government deficit expansion come to an end later this year these winds at gold’s back could become headwinds….Goldman’s controversial note follows:

“We realize that, for many, discussing gold is tantamount to debating religion: each side is likely to have deeply held views, neither side is likely to concede despite persuasive arguments, and one’s ultimate viewpoint is largely a matter of faith. Part of this mystique reflects the difficulty in determining what gold is actually worth, since it is a non-productive asset that generates no cash flows to value. It also reflects

the unstable nature of gold’s price drivers: sometimes it responds intuitively to supply/ demand dynamics like most commodities, while other times it reacts more like a financial asset, taking its direction from the dollar or inflation expectations.However, while investors may trade gold as a dollar or inflation hedge, its performance in that capacity has been spotty historically. More specifically, changes in the dollar explain only 16% of the changes in gold, while shifts in real rates explain another 12% and CPI accounts for a mere 18% (Exhibit 42). Thus,

these typically cited justifications for owning gold account for less than half its historical price movements! Furthermore, in 60% of the episodes when inflation surprised to the upside in the post-World War II period, gold has actually underperformed inflation. As a result, gold has not been a consistent inflation hedge, although it is purchased as one en masse.Of equal importance, investors purchasing gold as a form of tail risk insurance against monetary debasement should appreciate the potential effectiveness and costs of that insurance. For instance, during the recent financial crisis, gold actually declined over 30% from its peak in March 2008 through its trough in November 2008, while the dollar served as the better safe haven, rallying 24.3%. Furthermore, gold prices have already advanced on expectations of high inflation and dollar weakness, suggesting that the failure of either to materialize, as we expect, could lead to downside risk. In addition, gold has volatility similar to equities, and has, in fact, experienced a larger peak-to-trough decline in price when compared

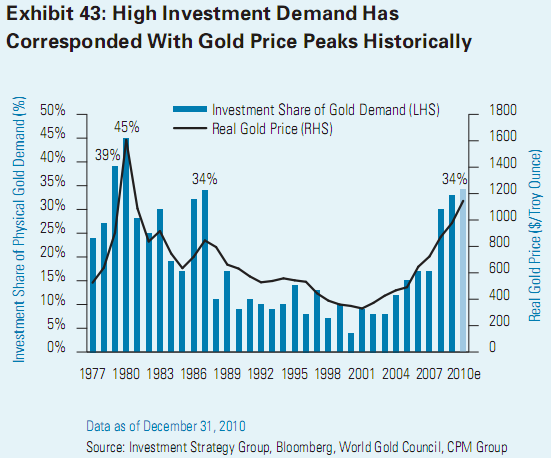

to equities over rolling three-year windows since 1969 (-64.5% for gold vs. -56.8% for equities).In short, gold is not an appropriate substitute for the “sleep well” portion of a client’s portfolio, in our view. The shifting composition of gold demand is another important consideration. In just the last 3 years, investment demand increased from 17% to an estimated 34% in 2010, while jewelry demand (gold’s natural buyer) now represents less than half of the total, according to the World Gold Council. As a result, the investment demand for gold is reaching euphoric proportions, with a recent press report announcing the availability of gold-dispensing ATMs in select markets this year! Already, the SPDR Gold Trust has become the second largest ETF in the world and now represents the 5th largest stockpile of gold globally, exceeding the gold reserves of China and Switzerland. The demand characteristics of gold producers have changed as well. Indeed, the major gold miners have spent the last several years repurchasing their gold hedges. With that process now near completion, another source of natural demand will be absent from the market this year. The obvious risk in all this is that investors tend to be fickle, suggesting that gold demand

could quickly evaporate, leaving few natural buyers at today’s elevated prices. In fact, jewelry demand tends to be negatively correlated with gold prices, which leaves fewer buyers should investment demand falter. For their part, gold producers could start re-hedging their books if prices fell, pressuring gold further. Notably, investment demand levels similar to today have tended to correspond with peaking gold prices, as seen in Exhibit 43.”

“While some have suggested central banks could fill any void in demand, we do not expect them to be a swing factor for several reasons. First, developed market central banks hold the vast majority of gold reserves. Thus, unless there is a significant global move away from the dollar into gold, which we don’t expect, the marginal shifts among emerging market central banks will not prove decisive. Second,

central bank activity has been a poor predictor of gold prices historically. For instance, central banks were net buyers in the early 1980s as gold prices collapsed. Lastly, it’s not clear whether central banks will continue to be net buyers, as they were last year. For example, the average Eurozone member has gold reserves in excess of 30% (with some countries’ reserves well in excess of 50%), despite an ECB target ratio of 15%.For our part, we expect a combination of stronger US growth, a strengthening dollar, temperate inflation and generally higher risk-asset prices to raise the opportunity cost of holding gold, particularly as real rates normalize higher. Even so, momentum is a powerful market force, and it’s unclear how long strong investor demand will persist. Given these competing tensions, gold does not screen as a compelling tactical opportunity in our framework.”

Source: Goldman Sachs

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.