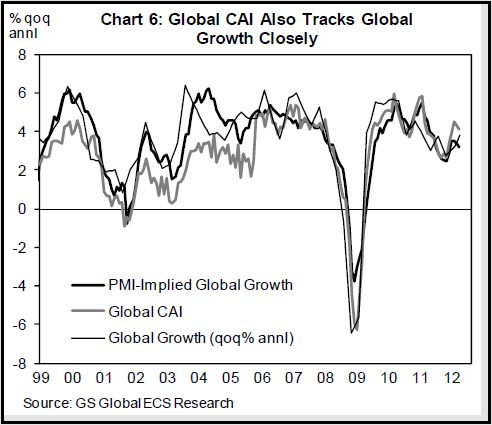

Goldman Sachs has developed an indicator that I’ve previously discussed here. It’s essentially an attempt to create a better real-time indication of global economic growth than the global PMI’s and many of the other indicators investors often reference. Although it hasn’t been in use for very long it’s tracked fairly well thus far. The latest update points to continued global growth and economic growth that is stronger than some of the negative PMI reports we’ve been seeing abroad (via Goldman Sachs):

“We now have sufficient CAI coverage to aggregate the country-level series into a PPP-weighted Global CAI Aggregate. Like the output of our Global PMI-Implied Growth Model, the Global CAI is an approximation of the current sequential rate of global growth. Our Global CAI is currently tracking at 4.1%, nearly a full percentage point higher than our PMI-based estimate and also above our and consensus forecasts. This divergence may reflect two things: (i) our Asia CAI data is currently only available through March and (ii) European national business surveys have significantly outperformed PMIs recently.”

Source: Goldman Sachs

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.