We all know that QE has a substantial psychological impact on the market. Perhaps more importantly, depending on how such a program is implemented and in what environment, it can be extremely powerful. One of the more noticeable stories has been that of Japan where Abenomics has appeared to be at least a marginal success in recent years. Whether this has been mainly due to the exchange rate or due to other factors is impossible to know, but one thing appears to be certain – the positive directional trend of many indicators appears to have changed from a steady rise to a steady sideways.

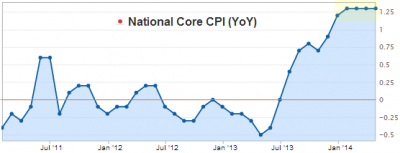

As our friends over at Sober Look note, inflation appears to have stopped rising as the persistent low inflation trend continues to exert itself:

The Nikkei Index, which looked like a one way bet for 6 months, has stalled:

The Yen rally has stalled:

This remains one of the most interesting monetary experiments in the world today. If the central bank is able to pull Japan out of its sustained deflation then we will likely see a permanent change in the way central banks engage their economies. But I wouldn’t get too hopeful. Not only do I fear that this has been primarily exchange rate driven, but I also fear that Japan’s terrible demographic trends are something that no central bank can overcome. And of course, that assumes QE has the power to sustain a recovery or avert disaster in the first place, which I tend to think is a position that’s overstated.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.