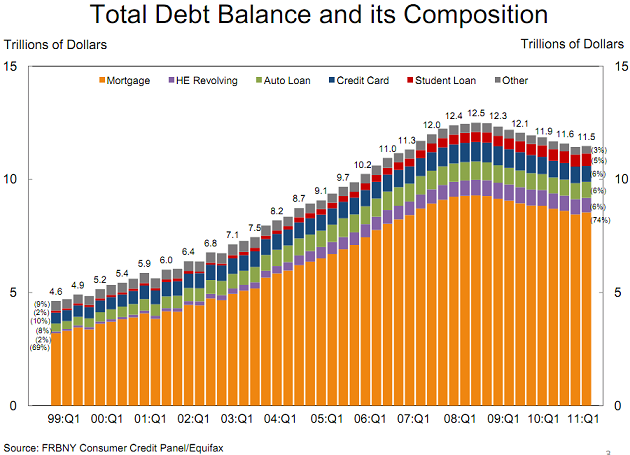

The NY Fed has released their quarterly report on household debt and it is showing the first quarterly improvement in 9 quarters. They report:

“Aggregate consumer debt held essentially steady in the first quarter, ending a string of nine consecutive declining quarters. As of March 31, 2011, total consumer indebtedness was $11.5 trillion, a reduction of $1.03trillion (8.2%) from its peak level at the close of 2008Q3, and $33 billion (0.3%) above its December 31, 2010 level. Behind the leveling off of total consumer debt, was a small increase in mortgage balances shown on consumer credit reports.”

At first glance, this might sound like a net positive. I would argue, however, that aggregate debt levels remain unsustainable as seen in the continuing high levels of debt:income ratios. The fact that debt is on the rise again is merely a sign that the Fed’s perverse policies have done just enough to convince consumers that it’s wise for them to increase their debt levels. This is another good sign for the economy in the near-term as increased debt is a sign of increased economic activity, however, I think it calls into question the sustainability of any recovery. After all, this looks like another sign that the government’s policies have merely kicked the boom bust cycle back into full gear. And that works until it doesn’t….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.