Goldman Sachs analysts have become the epitome of bullishness in recent months. Jan Hatzius their Chief US Economist says the says GDP growth will come in at 3.5%-4% in 2011 and that corporate profits will continue to accelerate as the economy gains momentum. This will lead to stronger jobs growth and a continuing economic recovery. In the following video Hatzius elaborated on his outlook for the labor market and the general economy:

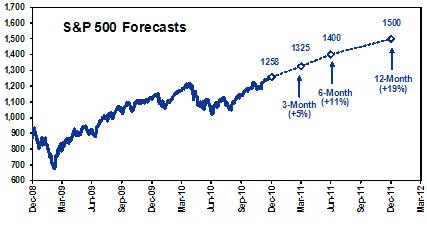

Hatzius is far from being the most bullish analyst at the firm, however. On Friday David Kostin, their Chief US Equity Strategist upgraded his outlook for the equity markets and now has a target of 1500 on the S&P (via ZeroHedge):

We are raising both our 2011 and 2012 S&P 500 earnings estimates by $2 per share to $96 and $106, reflecting annual growth of 14% and 11%, respectively. We boost our year-end 2011 target to 1500 representing a potential total return of 21% including the 2% dividend yield. Our 3- and 6-month interim targets are 1325 and 1400, respectively. A re-accelerating US economy will drive 8% sales growth and explains our pro-cyclical recommendations. Focus on stocks with high beta to both the US economy and the stock market and firms with rising return on equity (ROE).

We expect 2011 EPS will reach a new high 5% above the prior peak

Goldman Sachs US GDP forecasts are above consensus for 2011 (3.4% vs. 2.6%) and 2012 (3.8% vs. 3.1%). A 50 bp shift in GDP growth equals $2 per share in EPS and every 50 bp shift in profit margins equals $4 per share.Raising our S&P 500 year-end 2011 price-target to 1500

We forecast that at year-end 2011 the nominal size of the US economy will be 5% larger than today, the level of forward EPS will be 11% higher, the P/E will have expanded by 8% or 1 point, and S&P 500 will be 19% higher.

Themes: Buy (1) Cyclicals; (2) High beta; and (3) ROE growth

Our best ideas for 2011: (1) Long Cyclicals/short Defensives; (2) Stocks with high beta to both the US economy and stock market; (3) Growth in return on equity; (4) High Sharpe ratios; (5) High dividend growth.

Source: GS, Bloomberg

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.