Jan Hatzius of Goldman Sachs had some interesting commentary on the deficit the other day. You’ll recognize the sectoral balances chart in his work as he’s one of the few analysts on Wall Street who seems to really appreciate the importance of Wynne Godley’s work.

Here, he describes the 3 reasons why the deficit is about to slide in the coming years:

“There are three main reasons for the sharp reduction in the deficit:

1. Lower spending. On a 12-month average basis, federal outlays have fallen by a total of 4% in the past two years, the first decline in nominal dollar terms over a comparable period since the demobilization from the Korean War in the mid-1950s.

2. Higher tax rates. The increase in payroll tax rates in January 2013 has boosted federal receipts by around $120 billion (annualized), or about 0.8% of GDP.

3. Economic improvement. Although real GDP has only grown at a sluggish 2%-2.5% pace since the end of the 2007-2009 recession, this has been enough to generate a sizable improvement in tax receipts, over and above the more recent impact of higher tax rates. Even prior to the tax hike that took effect in early 2013, total federal receipts had grown by 7% (annualized) from the 2009 bottom, nearly twice the growth rate of nominal GDP.

We expect the deficit to continue to decline and are forecasting a deficit of 3% of GDP or less in fiscal 2015. Some of this is policy-related. Sequestration has barely started to show up in the outlay data, and the expiration of the Bush tax cuts for high income earners in 2013 is likely to reduce tax refunds and boost final settlements in early 2014. In addition, the two parties are calling for further spending cuts and/or tax increases (although it is unclear whether these will be enacted).

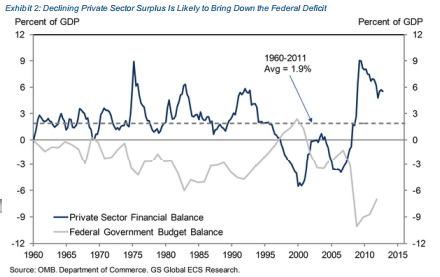

But the more important reason, in our view, is that there is still a great deal of room for the economic recovery to reduce the deficit for cyclical reasons. The key to this forecast is our expectation that the private sector financial surplus–the difference between the total income and total spending of all households and businesses–will decline substantially further from the 5.5% of GDP reading of the fourth quarter of 2012 toward the historical average of 2% of GDP.

As a matter of accounting, this reduction must be mirrored in a drop in the federal deficit, a drop in the state and local deficit, an increase in the current account deficit, or a combination of all three. In practice, however, we expect it to translate primarily into a decline in the federal deficit, as tax receipts rise and outlays decline (e.g. via reductions in the unemployment rolls.) This expectation is consistent with the historical record. As shown in Exhibit 2, there has been a close inverse relationship between the private sector balance and the federal government balance in recent decades, with a correlation in annual data of -0.72.

And the conclusion from Hatzius:

“In our view, the most important implication from the reduction in the budget deficit for the near-term economic outlook is reduced pressure for further fiscal retrenchment. Partly for this reason, we expect the drag from fiscal policy on real GDP growth to decline sharply from around 2% of GDP in 2013 to around 0.5% in coming years. This is a key reason for our expectation that real GDP growth will accelerate from around 2% (annualized) in Q2/Q3 2013 to 3%-3.5% in 2014-2016.”

I’d only add that it’s important that the private sector’s de-leveraging is slowing and even turning into a re-leveraging to some degree. This means the private sector is healthier than most presume and that the government deficit isn’t needed to power private growth as much as it has been in the last few years. This passing of the baton is important in understanding the future trajectory of the economy. The decline in the deficit is as much as a result of mild government austerity as it is a sign of increased private sector health.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.