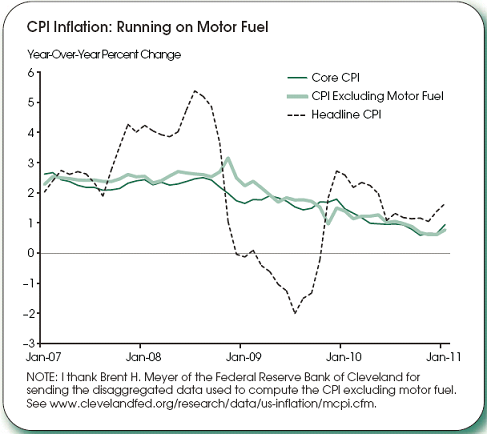

The St Louis Fed has a nice piece of research out today that really puts the inflation (non) concern into perspective. They show the CPI ex motor fuel and conclude that most of the noise coming from headline CPI in recent years is due to this ONE factor:

“Although food and energy prices have moved in the same direction recently, partially due to the increased use of grains in energy production, fluctuations in the price of motor fuel (mainly gasoline) have caused most of the monthly noise and year-over-year fluctuations of headline CPI inflation over the past four years. Motor fuel is just one category in the energy component—the others are gas (piped), electricity, fuel oil, and other fuels—but motor fuel is a special case, as the chart shows.”

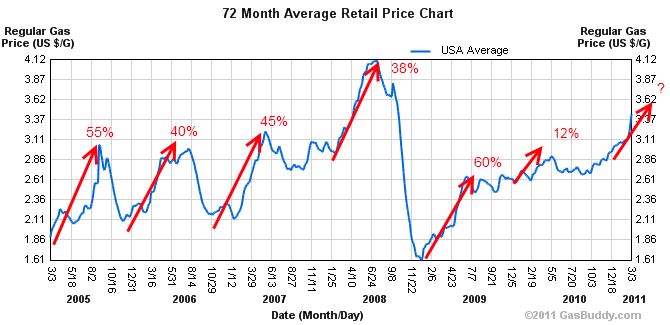

Anyone familiar with the oil and gas industry knows that there are strong seasonal trends at work here. I have noted since late last year that the combination of QE2 and seasonality would make for a very dangerous combination when it comes to gasoline prices. This chart, which I posted in March, shows the strong seasonal trends:

Gasoline prices are up 16% since then and continue to move north. At the beginning of 2011 I described why oil and gasoline prices were likely to continue surging into the summer:

“What’s worrisome today is that oil prices are surging during a normally weak seasonal period. The seasonally strong period during the late winter into the summer driving season tends to be when oil prices surge and top out. There is a very real threat that oil prices will continue to melt-up into the middle of the summer.”

I also said headline inflation was likely to continuing moving north – in large part due to my bullish stance on oil and gas prices. This is important to note because of the strong influence that energy can have on the headline CPI data. So, from an inflation standpoint we should likely expect higher energy prices into the end of the summer driving season. This likely means we can fully expect headline CPI to continue moving north (though there is still almost no risk of hyperinflation in this environment). Core CPI, however, should remain relatively muted due to the continuing weakness of the recovery and the de-leveraging consumer. And if gas prices surge to levels that put a serious dent in consumer spending we might very well be having a deflation conversation in late summer again….And if you’ll recall, that was the conversation late last year that preempted QE2 and helped cause this energy debacle to begin with. Oh what a tangled web the Fed weaves….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.