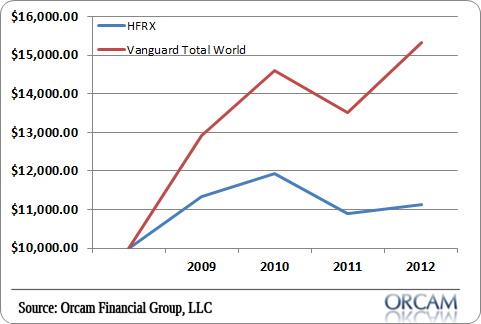

Here’s an interesting chart of the day for you. It shows the total returns of the HFRX Global Hedge Fund Index versus the Vanguard Total World ETF. The results are telling even though the sample size is small.

Had you invested $10,000 in both indices at the beginning of 2009 when the global economy was starting to recover you would have a total return of 11.12% in the HFRX versus 53.41% in the Vanguard Total World fund. That’s the difference between $11,125 and $15,341. And that’s before you consider the taxes and fees embedded in the funds.

Perhaps the most interesting point in there is the 2011 performance. Hedge funds are designed primarily to capture alpha regardless of the investing environment. They’ve clearly done an okay job capturing some of the upside in recent years, but 2011 was a disaster. They underperformed the Vanguard Index by 1.3%. So, not only have the hedge funds failed to capture all of the upside, but they didn’t even protect you in the one negative year.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.