I’ve argued in recent days that valuations metrics won’t help you time the market. To be clear – I am not saying “valuations don’t matter”. I am simply pointing out that valuations are dynamic and using an aggregate value metric probably tells you a lot less than you think. That said, I also wanted to provide some perspective from an interesting piece that was forwarded to me by a reader citing the smart people at Ned Davis Research:

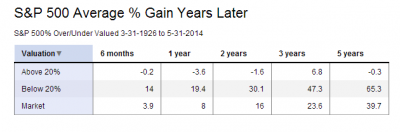

“Looking at history, the stock market’s returns depend a lot on where equity valuations are when you start the clock. Ned Davis Research has done the math, comparing the actual levels of the S&P 500 Index each month with a “normal” valuation of the index based on fundamental factors like P/E, dividends, earnings, and cash flows. They identified points when the market was over- or undervalued by at least 20% and they crunched the numbers on performance after each of these points.

The performance difference is dramatic. On average, one year after a low valuation, the market rose by 19.4%. One year after a high valuation, it dropped by 3.6%. When the market has been fairly valued, it increased 8.0%. Also note the returns one, two, three and five years later.

Data through 5-31-2014 shows the market to be 33.240% overvalued. This says risk is high in holding stocks right now yet it is important to note that the market could extend even further driven by QE, foreign capital inflows or the return of the retail investor. I am simply pointing out prospects for future gains are much lower at current P/E multiples than they are at more normal levels. Understanding where you are at any point in time can help you decide to either position your portfolio more aggressively, or position it more conservatively. If risk is high, hedge what you have. If risk is low, get aggressive and buy. In this regard, valuation measures may not be a good timing tool but they are a good risk measuring tool.”

Of course, this is all using historical data. The same historical data I say doesn’t necessarily apply to the current market environment. So I don’t know where that leaves us. One thing we probably all agree on is that there remains a certain discomfort around the equity markets after the huge surge in prices, the fallacious sort of feel surrounding QE and the high “valuations”. I don’t know if any of that helps us construct a model for asset allocation (it certainly doesn’t drive mine), but maybe all of this gives you some better perspective.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.