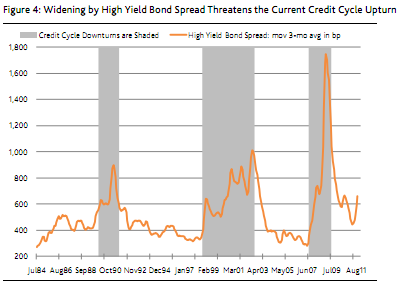

In a recent research note Moody’s credit analysts note the action in the high yield bond market being consistent with leading recession indications:

“the widening by the high yield bond spread from an April 2011 average of 442 bp to a recent 732 bp warns of a possible quick end to the current credit cycle upturn. Each previous widening by the high yield bond spread to a width in excess of 700 bp occurred in the context of a credit cycle downturn that included a harsh and extended slump by high yield debt issuance. The record also shows that recessions tend to occur whenever the high yield bond spread’s month-long average tops 700 bp. The only exception to this tendency was the second half of 2002, or when a recession failed to materialize notwithstanding the high yield bond spread’s 784 bp average of that span.”

Now, I’ve been fairly clear that I think the “double dip recession” argument misses the point, but I think the message from high yield confirms other fears – credit markets are becoming increasingly fragile and are consistent with other very weak periods of economic growth. As Moody’s notes, these events tend to be protracted events. This is all consistent with the balance sheet recession theory.

Source: Moodys

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.