Back in 2008 Paul Krugman asked an important question – “how close are we to a liquidity trap”? He explained his thinking very clearly:

“Here’s one way to think about the liquidity trap — a situation in which conventional monetary policy loses all traction. When short-term interest rates are close to zero, open-market operations in which the central bank prints money and buys government debt don’t do anything, because you’re just swapping one more or less zero-interest rate asset for another. Alternatively, you can say that there’s no incentive to lend out any increase in the monetary base, because the interest rate you get isn’t enough to make it worth bothering.

Normally it doesn’t matter which short-term interest rate you choose — the Fed funds rate, which Uncle Ben sets, is usually very close to the interest rates on US government debt. But right now we’re in a situation in which Treasury bills yield considerably less than the Fed funds rate; to at least some extent this may reflect banks’ nervousness about lending to each other, even in the overnight market. And to the extent that’s true, Treasuries — not Fed funds — are the interest rates to look at.

As of 10:38 this morning, the one-month Treasury rate was 0.57; the three-month rate was 0.825.

Are we there yet? Pretty close.”

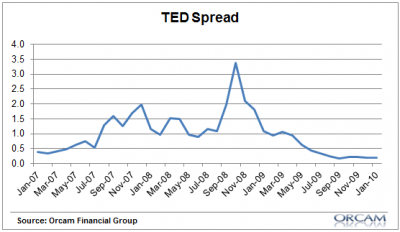

As of today the one-month Treasury rate was 0.01% and the effective Fed Funds rate is 0.09%. But of course, banks aren’t nervous about lending at all. Certainly not in the overnight market. So, by Krugman’s own logic we should be in a liquidity trap and banks should be nervous to lend, but that’s obviously not happening. Now, this did occur briefly during the crisis. We can see this in the TED Spread during the 08-09 period. That big spike in the chart below is a sure sign of what Dr. K was talking about. Banks didn’t want to lend to one another. But that environment is long gone. We’re not in a liquidity trap at all. Banks and other agents aren’t holding cash because it’s a close substitute for bonds. In fact, the strong demand for bonds of all types is a clear sign that people would love to have a higher interest bearing asset of any type.

Why does this matter? Well, I see that Dr. Krugman is pounding mercilessly on Bill Gross and his interest rate call (deservedly so). And he’s declaring victory on the grounds that Gross was using a flawed methodology based largely on ideology. But the odd thing is that Dr. Krugman is being no different. He’s relied on the liquidity trap theory throughout the crisis and this idea that the natural rate of interest was negative which meant that the interest rate transmission mechanism stopped working at the zero lower bound. This all sounds great in theory, but it doesn’t make a lick of sense when one looks at the actual evidence.

Yes, conventional monetary policy via interest rate changes has proven ineffective during the crisis. But so what? Anyone who understands how banks operate knows that the Fed Funds Rate is just a benchmark rate that influences the spread at which banks earn a profit. It isn’t and was never some omnipotent policy tool that determined how the entire economy operates. To those of us who understand banking the crisis only proved this point true – interest rate changes didn’t suddenly become a blunt instrument – they’ve ALWAYS been a blunt instrument. But many mainstream economists continue to think we’re in some strange environment where interest rates just don’t work like they used to. Did they ever consider that maybe their theories are flawed and based on misconceptions? Or are they going to claim the world is now in a permanent liquidity trap even though, by their own description, that definition doesn’t apply? After all, being right matters. But being right because you used a flawed methodology doesn’t make you smarter than someone who used a flawed methodology and was wrong – it just means you’re luckier than they are.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.