Analysts at UBS have recently published an idea for how Eurobonds could work. Now, we’re clearly not at the point where e-bonds are a reality, but I still believe that e-bonds are the bazooka that is most likely to be pulled in the case of a serious downward spiral in the Eurozone. The most likely trigger here would be a decline in the Italian economy, debt reduction failure, surging interest rates and the ECB eventually realizing that the current form of QE will not be enough to contain bond vigilantes.

UBS has laid out the scenario in which Europe could essentially put an end to the solvency crisis (FT Alphaville also touched on this idea yesterday). UBS proposes an implementation of E-bonds with immediate funding up to a maximum level of 60% of GDP:

“But there is a problem with implementing it now. Most euro area member states already have debt levels well over 60% of GDP, so the issuance of subordinated debt in addition to that might be problematic. Indeed, it is very possible that states other than Greece, Ireland, and Portugal find themselves unable to issue debt at all in the private markets in the near future, which would mean that the subordinated tranche would become redundant.

In December of 2010, Luxembourg president Jean-Claude Juncker and Italy finance minister Giulio Tremonti made the first formal proposals by government officials for a eurobonds scheme. They suggested that a European debt agency be created to issue common debt up to 40% of member states’ individual GDP, with up to 50% of new issuance coming from eurobonds. In the case of countries whose access to markets is impaired, up to 100% of new issuance should take place that way, according to their plan.

The previous May, Jacques Delpla of the Conseil d’Analyse Économique and Jakob von Weizsäcker of Bruegel proposed in their paper “The Blue Bond Proposal” that issuance should be made in both commonly-guaranteed bonds (blue bonds) and individually guaranteed bonds (red bonds) on a simultaneous basis.

By merging the implementation ideas of both proposals, we arrive at what we believe to be a simpler solution: From the point at which eurobonds can come into existence, all euro area governments should issue 100% of their debt in the form of eurobonds, until the stock of eurobond debt reaches 60% of their respective GDP. After that point, governments will have to issue debt on an individual, subordinated, basis.

In the time over which governments would amass eurobond debt equivalent to 60% of their respective GDP, most governments should be easily able to make the necessary adjustments to their deficits and structural changes to their economies. For those that will not likely be able to do so, most obviously Greece, a restructuring of existing debt would have to accompany the move to eurobonds. But for those issuers whose sovereign debt markets are currently suffering more as a result of liquidity worries than solvency concerns, most notably Italy and Spain, the grace period before they would need to return to the markets by themselves could amount to a significant number of years.”

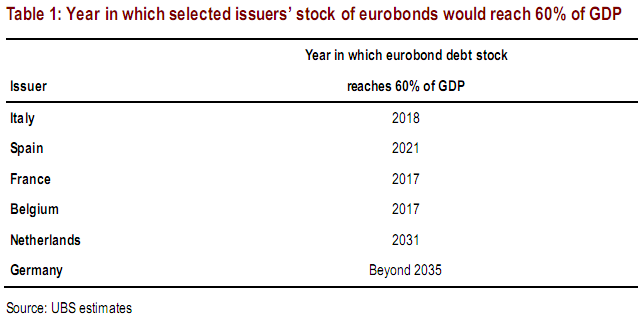

UBS goes on to establish a very specific timeline for the debt levels and funding via e-bonds for each nation:

This would work. And by “work”, I mean it would immediately end the liquidity crisis on the periphery. It won’t solve their economic woes (austerity would remain) and it won’t necessarily avoid any restructurings, but what it would do is remove any worst case scenario that could potentially end in total banking system failure across Europe (something which can’t be entirely discounted if Germany is serious about not bailing out Italy). So, Europe has the solution sitting right in front of them. It’s just a matter of whether they can muster the political will to recognize that they’re all in this together. The alternative is letting the markets decide for them. And bond vigilantes don’t care much for politicians or nationalism.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.