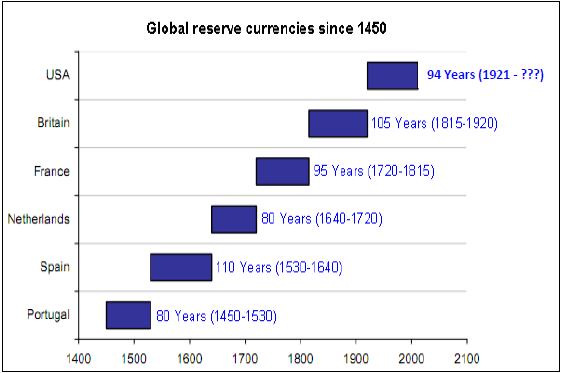

The US Dollar’s status as a reserve currency seems to be a perennial concern for many people these days. I think this concern is often dramatically overstated. I was reminded of this point as I was reviewing the slides from Jeff Gundlach’s presentation yesterday which showed the following chart:

(Source: DoubleLine)

As you can see, no one maintains reserve currency status forever. That shouldn’t be remotely surprising. The global economy is dynamic and market shares shift. And at the end of the day that’s what reserve status is really all about. Think about it – nations accumulate reserves of US dollars today because the US economy is the dominant player in global trade.

Of course, the US Dollar isn’t the only currency that nations maintain reserves of. The Euro is also a major reserve currency and the Yuan is fast becoming a major reserve currency. But since the USA produces 22% of all world output it happens to play a particularly special role in the global economy. By virtue of being the largest economy in the world the accumulation of US dollar denominated financial assets happens to dominate the global financial system. It’s sort of like being the top market share producer of a particular product in a particular industry. Other entities accumulate your products because you’re the top producer. And that changes over time. Market shares change and regimes shift with the evolving economy.¹

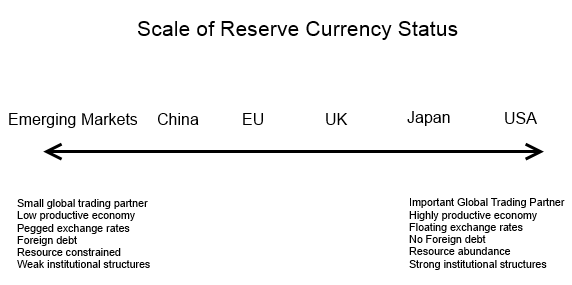

When we talk about “reserve currency” status we often think of some sort of status that has been bestowed upon that currency. The reality is that reserve currency status is earned as a function of economic prowess. There are many reserve currencies, but some are more important and stable than others. So it’s better to think of reserve currency status as existing on a scale similar to the diagram below:

So, will the USA lose its reserve currency status at some point? Yes. In fact, it’s already starting to lose its reserve status to Europe and China. Will it be the end of the world and will it cause everyone to suddenly ditch the dollar? Probably not. It just means the USA will produce a lower proportion of global output and therefore, as a matter of accounting, the rest of the world will hold a lower percentage of US dollar denominated financial assets as a percentage of global output. It’s not the end of the world. It’s just a sign that market shares change and when you’re #1, well, there’s only one direction to go.

¹ – Data on the quantity of reserves held by foreign countries can be found at the IMF’s COFER website.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.