James Carville once said:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

Carville was very close to getting this right. The only problem is, he fell for the old bond vigilante belief. What Carville should have said was this:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the Federal Reserve. You can intimidate everybody.”

I’ve spent a great deal of time trying to debunk the idea that bond markets will one day revolt and cause the Fed to raise rates which will appear like bond vigilante justice. Many market commentators have used the European crisis to prove this point. But of course, the EMU is made up of currency users and not currency issuers. There is a very real solvency constraint in each EMU country that adds a layer of risk to their bond markets. Bondholders know this and it causes a vastly different dynamic than it does in a country like the USA or Japan where the government is a supplier of its currency in a floating exchange rate system.

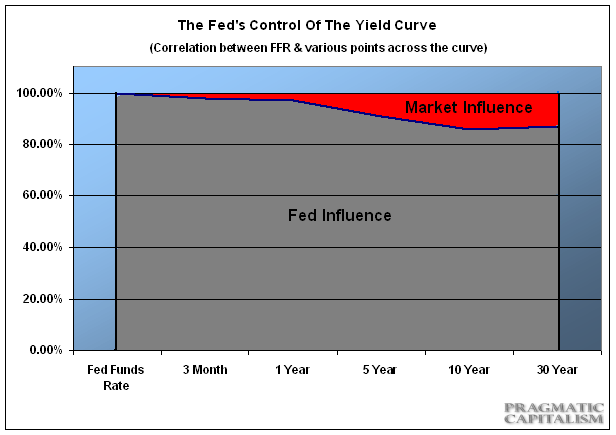

To illustrate this point I ran a few correlations across the yield curve in the USA. I took various durations and found the correlation between the monthly movements going back 40 years (less so in the case of the 30 year) and the Fed Funds Rate. What I found surprised even me. The data shows a remarkable correlation even at the long end of the curve. Naturally, the Fed controls the Fed Fund’s Rate, but as we went out on the curve the correlations remained very tight (FFR at 100%, 3 month at 97%, 1 year at 96%, 5 year at 91%, 10 year at 86%, 30 year at 87%). Even at the longest duration there is an 87% correlation between the movements of the Fed Funds Rate and the 30 year bond. In other words, the bond market is the Fed’s whipping boy. Not the other way around.

What’s interesting in this data is that the bond market is taking its cues almost entirely from the Fed. The market, as one might assume, actually wields very little control over the long end of the curve. This isn’t entirely surprising as long rates are really just an extension of short rates. But it is somewhat surprising to see the incredibly high level of correlation that we’ve found here.

What’s more interesting is that there appears to be no worry of solvency in this data. The last few weeks have been particularly interesting. Even as a default risk loomed the bond market appeared to be whistling past the graveyard. I have argued that there is no solvency constraint for a nation that issues its own currency in a floating exchange rate system. But the bond market clearly doesn’t adhere to the beliefs of me. What it does adhere to, however, is the beliefs of the Fed. And the Fed’s message has been very clear in recent weeks:

1) The US government should absolutely not be allowed to default. Ben Bernanke made this abundantly clear in a speech several weeks ago.

2) The economy is weakening.

To bond investors these messages from the Fed are like siren calls to buy bonds as they perceive the Fed’s accommodative policy as being a near certainty in the coming months. As we see above, the easy Fed means the long end of the curve should remain a decent bet. Bondholders are putting their money where the Fed’s mouth is.

The bottom line here – the old adage “don’t fight the Fed” should be plastered in the hallways of every bond trading desk in the world. And when I come back I want to come back as the Federal Reserve. Then I can intimidate everybody.

Addendum – Several readers have listed concerns such as the fact that the 3 month t-bill appears to lead the Fed Funds Rate or that the correlations further out on the curve could be backward, ie, the long bond market actually leads the Fed.

First, I would note that we should expect to see the bond market lead the Fed Funds Rate to some degree in real-time. That is because the Fed always tries to influence market expectations via their announcements. In fact, this is always their intended goal via FOMC announcements. A good example of this was QE2 where Ben Bernanke announced the program several months before it actually started. These sorts of communications are intended to help the markets absorb these important changes in monetary policy well in advance of the actual changes.

As for the potential that I am datamining the correlation and reading it backwards – I would note that the correlation does indeed decline as we move further out on the curve. This is similar to the effect we would expect to see if you laid a very heavy fire hose on the ground and attempted to cause a ripple through the entire hose by shaking it up and down at one end. Clearly, the effects would be entirely controlled at the end nearest to your hands and the effect of the shaking would become gradually reduced as we moved further away on the hose. The impact in the market is somewhat similar. Clearly, based on this data, the effect on the long end is somewhat smaller than the effect at the ends closest to the Fed Funds Rate. One could view this as the Fed having marginally less control over the long-end, but still controlling the curve (as is clear from the still high correlation of 87% at the 30 year).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.