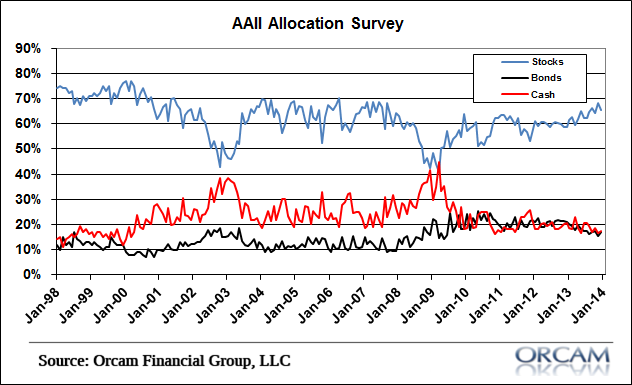

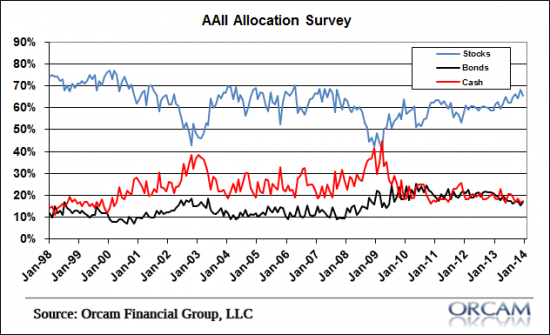

The latest AAII asset allocation survey showed a slight decline in bullishness about the equity markets. Stock holdings declined to 65.6%, down 2.7% from the previous month while bond and cash holdings were up 2.7%. The 65.6% allocation is shy of the highs seen in the late 90’s and much of the 2000’s, but still well above the historical average of 60%.

The survey also contained a sampling of responses regarding the taper:

Last month’s special question asked AAII members what, if any, the Federal Reserve’s decision to taper its bond purchases will have on their portfolio allocations. There was no consensus, though the largest group (42% of respondents) did not anticipate any impact. About 15% of respondents said they have reduced their bond allocations, while 5% shorted the duration (interest rate sensitivity) of their fixed-income holdings. Approximately 8% of respondents said they don’t hold any bond funds.

Here is a sampling of the responses:

· “None at this point; the taper is too small to have a large impact.”

· “None at this time. If interest rates begin to rise, I may adjust my bond fund allocation.

· “It will delay my purchasing of any additional bonds and bond funds, with the possible exception of very short duration bonds and bond funds.”

· “I increased my cash allocation relative to bonds. I have emphasized short-maturity bonds and bond funds in my portfolio.”

· “I will likely sell all of my bond funds, but hold the individual bonds until maturity.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.