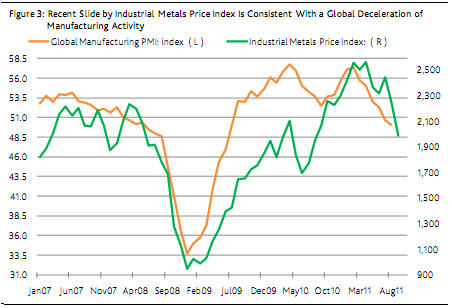

We’ve seen some incredible moves in the market over the course of the last two months, but last week really took the move to an extreme. As previously discussed, precious metals have plummeted, but industrial metals are also experiencing sharp declines. In a near repeat of 2008, we are seeing highly deflationary price action that is consistent with continuing economic weakness. And make no mistake, there is nothing consistent in this environment with a hyperinflation or even a stagflationary environment. I believe we’re likely to see a return of the disinflationary trend that we experienced in the first half of 2010.

In a recent commentary Moody’s elaborated on the alarming action in industrial metals (via Moody’s):

“In a stiff rebuke to inflation alarmists, the base metals price index now resides 25% under its record high of

April 11, 2011. Indeed, the severity of the latest plunge by base metals prices suggests that worry over

commodity price inflation might soon be supplanted by consternation over deflation. In an ominous

manner, the base metals price index recently fell 15% under its lagging 52-week average. The last time

these prices sank in a comparable manner was in the recession-bound month of August 2008.The latest slide by industrial commodity prices suggests that, unlike QE2, Operation Twist 2 will not swell

inflation expectations. QE2 probably encouraged an overbidding for commodities that a number of buyers

now regret. The latest plunge by base metals prices starkly shows the impossibility of sustaining rapid price

inflation without the full participation of the labor market. If sluggish wages and diminished access to credit prevent consumers from “affording” higher prices, inventories ultimately will outrun sales by enough to

prompt price discounting.”

We’re seeing an incredible confluence of events here as the Fed appears powerless, the economic slow-down continues and the global credit crisis persists. The disequilibrium that the Fed helped induce is now coming out of the industrial metals complex and as I’ve discussed in detail, we have to consider the very real possibility that this disequilibrium will exacerbate the economic slow-down. The precious metals decline might capture most of the headlines here, but keep an eye on the industrial metals. The action there is far more telling of global economic trends and just how bad this downturn is likely to get.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.