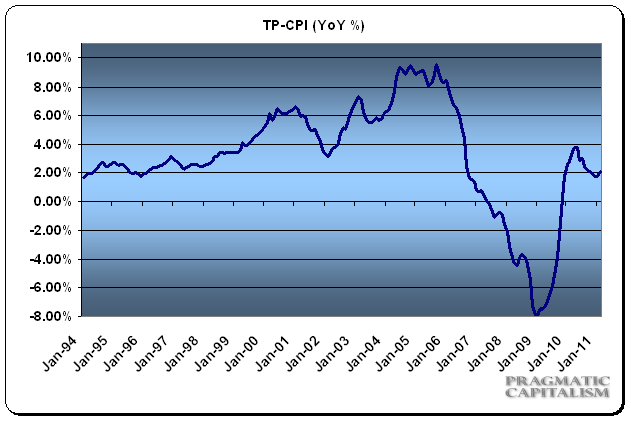

Not surprisingly, the surge in food and energy is causing an uptick in inflation. The increase is consistent with a modestly recovering economy though it remains well below historical levels. This morning’s CPI came in at 2.2% year over year. Econoday elaborates on the data:

“Prices pressures are rising at the headline level while the core remains on the warm side. The CPI in February jumped 0.5 percent, following a 0.4 percent boost in January. The latest came in higher than the median forecast for a 0.4 percent increase. Excluding food and energy, CPI inflation increased 0.2 percent, matching the rise in the prior month and topping expectations for a 0.1 percent advance.

Although the overall CPI was led upward by energy, food also played a major role. Energy surged 3.4 percent in February after increasing 2.1 percent in January. Gasoline jumped 4.7 percent, after increasing 3.5 percent the previous month. Also, heating oil spiked 4.1 percent, following a 5.4 percent hike in January. Food price inflation remained strong with a 0.6 percent increase, following a 0.5 percent gain in January. Five of the six major grocery store food groups posted increases. Notably, the index for fruits and vegetables increased the most, rising 2.2 percent as the fresh vegetables index increased 6.7 percent.

The core was led up by new vehicles, medical care, and airline fares. On the soft side was shelter which edged up marginally. The apparel index was one of the few to decline.

Year-on-year, overall CPI inflation increased to 2.2 (seasonally adjusted) from 1.7 percent in January. The core rate worsened to 1.1 percent from 0.9 percent on a year-ago basis. On an unadjusted year-ago basis, the headline number was up 2.1 percent in February while the core was up 1.1 percent.

Overall, today’s report points to a rise in underlying inflation pressures and normally would put upward pressure on interest rates. Flight to safety, however, remains strong.”

My inflation indicator, which includes a housing component, also ticked higher to a 2.1% annualized rate. If seasonality (and QE2) continue to play a significant role in market prices we should expect this trend in higher inflation to continue into the summer. Whether the consumer can ultimately sustain $4 gasoline is another question. Like 2008, I believe this has a very deflationary component to it. And that likely means inflation pressures are likely to remain relatively low as the economic recovery fails to generate sufficient growth (although there is growth).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.