Inflation declined on a monthly basis according to the latest data from the BLS. Month on month inflation declined -0.2% while the year over year rate held steady at 3.4% (seasonally adjusted). Core inflation actually rose on the month by 0.3%. The major movers in the index were energy which dropped -4.4%, gasoline down -6.8%, and food inflation up 0.2%.

The core rate, which the Fed is keenly focused on will likely give the Fed some pause. While it’s reassuring to see that some of the energy cost hikes have been transitory the rising core inflation is likely to make them hesitant regarding QE3. This is the key takeaway from today’s report.

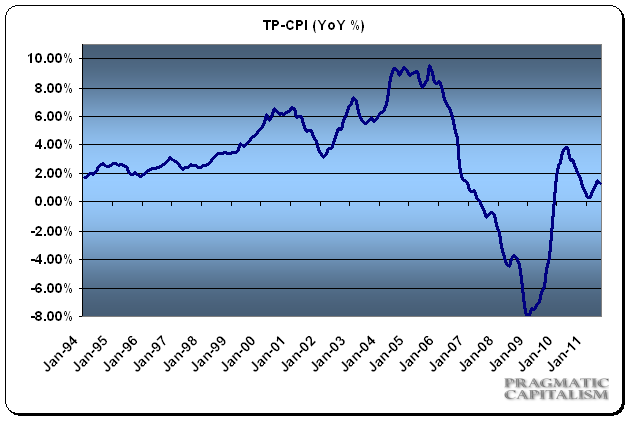

My inflation index, which includes a housing cost component, declined on a year over year basis. Historically, this index has tended to track a higher rate of inflation than the BLS reports. The recent declines in housing have played a key role in keeping this index subdued. This month’s report was no different as the index came in at just 1.3% year over year. The consumer’s largest asset continues to be a heavy burden.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.