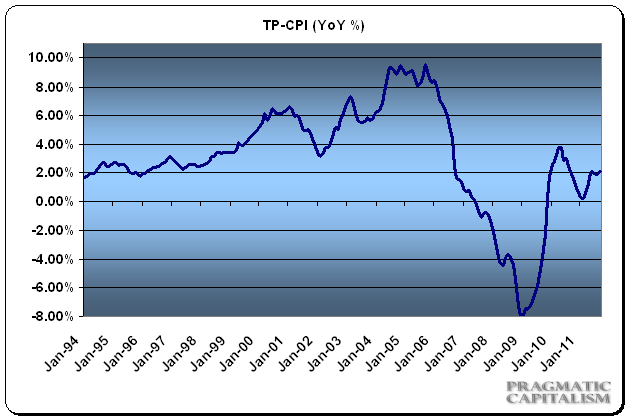

September’s CPI showed continued signs of moderate broad inflation with sizable gains from the energy sector. Headline inflation came in at 3.9% while core inflation was flat at 2%. That headline figure might sound high, but bear in mind that headline inflation has averaged 4% in the post WW2 era. Core inflation has also averaged 4% so from this perspective we’re actually still running well below average.

The primary cause of the price inflation is the energy sector. Headline minus energy came in at just 2.4% versus last year so it’s clear that the continually high energy prices are having a broad impact. This is alarming given the general weakness in the global economy. Energy prices just refuse to correct substantially. While international supply shocks and global demand are the obvious drivers, I think it would be terribly naive of the Federal Reserve to assume that their policies in recent years haven’t contributed to energy price shocks. And with core CPI running at the top of their range I have to think that this report has many inside the Fed feeling awfully uncomfortable about their options. This sort of CPI data does not bode well for future policy options as the Fed has to be wondering if they aren’t behind the curve.

My housing adjusted CPI came in at 2.2% which is a bit higher than the core report. All in all, the risk of high energy prices remains alarming, but general price inflation remains muted outside of this segment. I hope policymakers understand the potential risks associated with an environment such as this one. A policy such as open ended QE via NGDP targeting has the potential to be a total disaster for the cost push energy story…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.