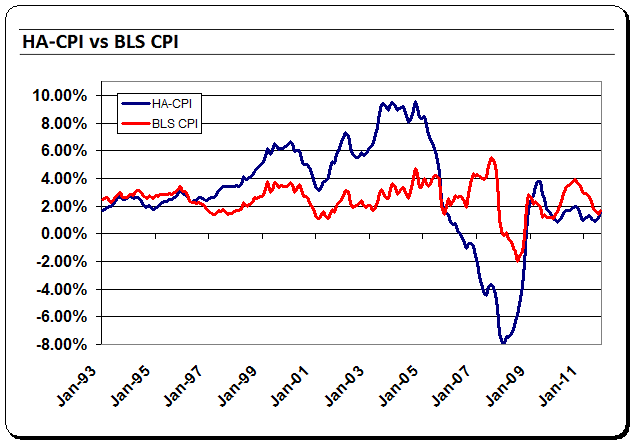

I’m crunched for time today so this is going to be brief. This morning’s CPI came in at just 1.7%, but we’re beginning to see some signs that the trend could be changing towards a rise in prices. While the BLS data was tame, my Housing Adjusted CPI came in hot compared to last month. The year over year reading of 1.6% is a full half percentage point higher than last month. This is a clear sign that improving housing prices are starting to filter through the economy.

This could make for an interesting environment going forward. A rising HA-CPI has tended to mean a stronger economy. I don’t think that’s different here as the rise in this month’s reading is certainly consistent with my “no recession” stance. And with the Fed’s latest QE program we’re likely to see other prices rising as expectations change. We know that long-term inflation expectations spiked on yesterday’s news.

But it’s also important to keep things in perspective. The long-term average rate of inflation is about 3.5% so even if YoY rates were to double from here we’d be back to average. In other words, this economy is still operating well below capacity with pricing power so low. So maybe a little inflation going forward wouldn’t be such a bad thing.

The concern with QE3 is that the inflation comes from the wrong places like speculation in commodity prices filtering through to gasoline prices, etc. We’ll be keeping a close eye on things as we move into 2013. For now, this looks benign, but prices are definitely creeping back up.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.